Climate Change

One of my main research streams is the design of policies to mitigate climate change.

SkyShares

SkyShares is a tool that I created while at the Center for Global Development to aid decision-making in international climate negotiations.

Decision-makers can use SkyShares to model the financial flows and economic costs of a climate deal where the world has set a carbon budget in order to limit dangerous and run-away climate change.

Atmospheric real-estate is running out. Any climate deal must be environmentally sound and set a cap on how much the world can emit. SkyShares calculates how much the world has left to emit using the latest scientific evidence.

CO2 allowances are valuable resources. Rather than thinking about climate as a burden-sharing problem, SkyShares allows users to model a climate deal as an asset-sharing problem in order to generate an equitable allocation of emissions permits in the climate talks.

Trading is a least-cost way for countries to reduce their emissions because it ensures decarbonization happens where it is cheapest. SkyShares can be used to compute an economically efficient climate deal.

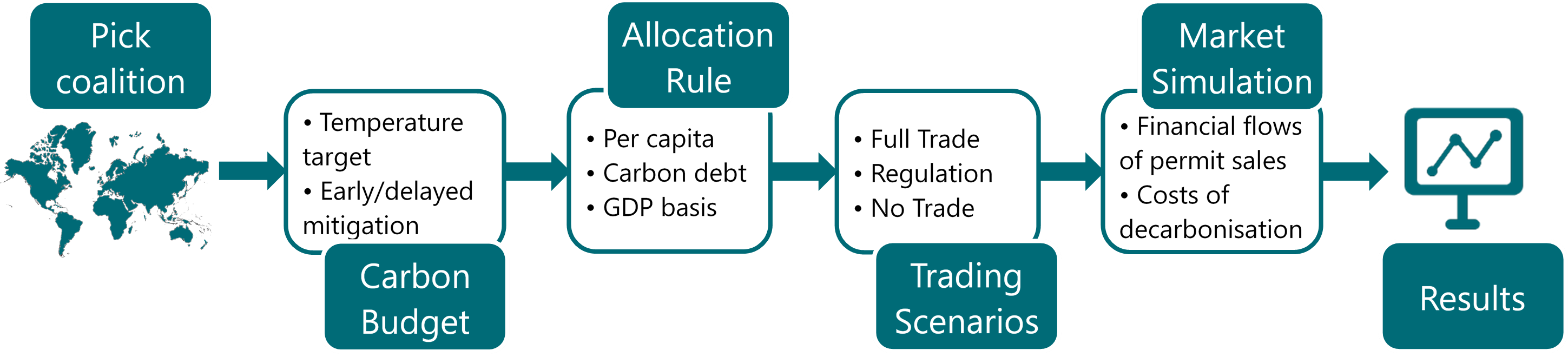

SkyShares allows users to simulate a Cap-Allocate-and-Trade deal.

Cap

Set a temperature target and see how much of the carbon budget we have left

Allocate

Decide how the carbon budget should be shared among countries

Trade

Calculate how much to decarbonize at home and how many allowances to buy

SkyShares offers various scenarios for the user to simulate the resulting economic and environmental consequences.

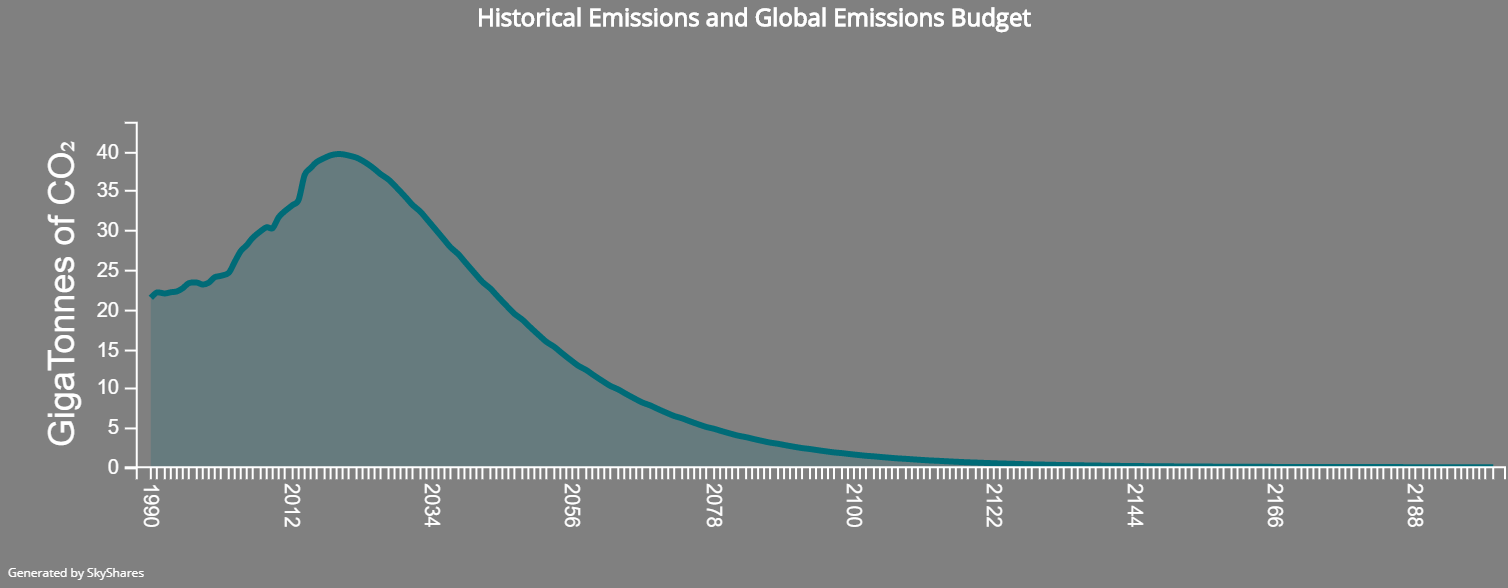

Carbon budget

SkyShares uses the latest scientific evidence to program the relationship between cumulative carbon emissions (all-time) and peak warming relative to pre-industrial levels. The user sets a temperature target, and SkyShares will return the remaining allowable emissions of CO2 in the budget. SkyShares then “spreads” the all-time cumulative emissions budget (a finite quantity) into discrete annual carbon budgets by plotting an idealized emissions pathway. The trajectory is a smooth-capped distribution which increases and decreases exponentially before and after the start of a mitigation scheme. The user can choose to delay the start of the global mitigation regime. SkyShares numerically solves for the required mitigation rate that ensures the planet’s emissions trajectory will stay within the confines of the global carbon budget.

Allocation rule

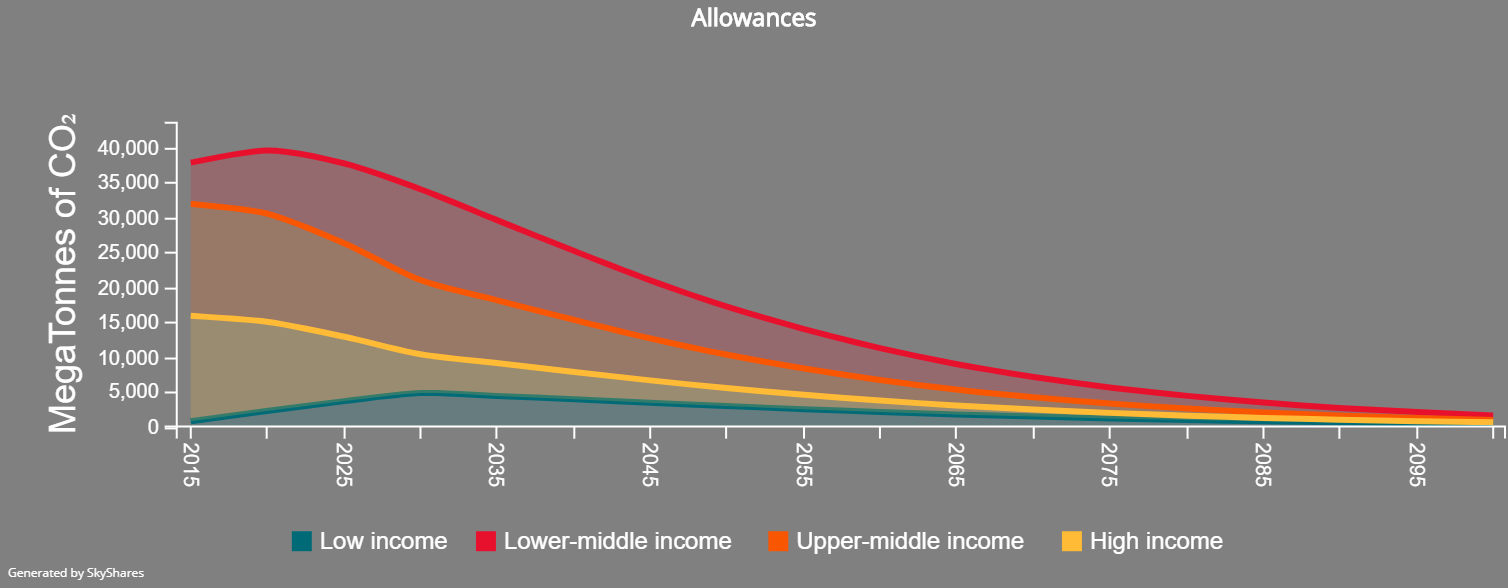

SkyShares offers a variety of algorithms to distribute the yearly carbon budget among the countries the user has chosen to participate in the coalition.

- Per capita: Allowances are grandfathered from current emissions shares and converge to per capita entitlements at a date chosen by the user.

- Equal stocks: Allowances also converge to equal per capita entitlements, but this takes into account the stock of past emissions. SkyShares computes the carbon owed by each country since 1800 or 1990, and future allowances are adjusted accordingly so that the carbon debt is paid back at the end of the century. The user can choose the repayment schedule for the servicing of that debt (linear, postpone or frontload).

- Historical responsibilities: Calculates the share of global emissions that past emitters have been responsible for, and mandates the same rate of mitigation effort in the future. This variant of the carbon debt scenario is more severe in its treatment of past emitters.

- Per dollar: Allowances converge to shares of GDP. This scenario distributes allowances to the richest, and is intended to help visualize the distributional implications of the status quo.

Trading scenarios

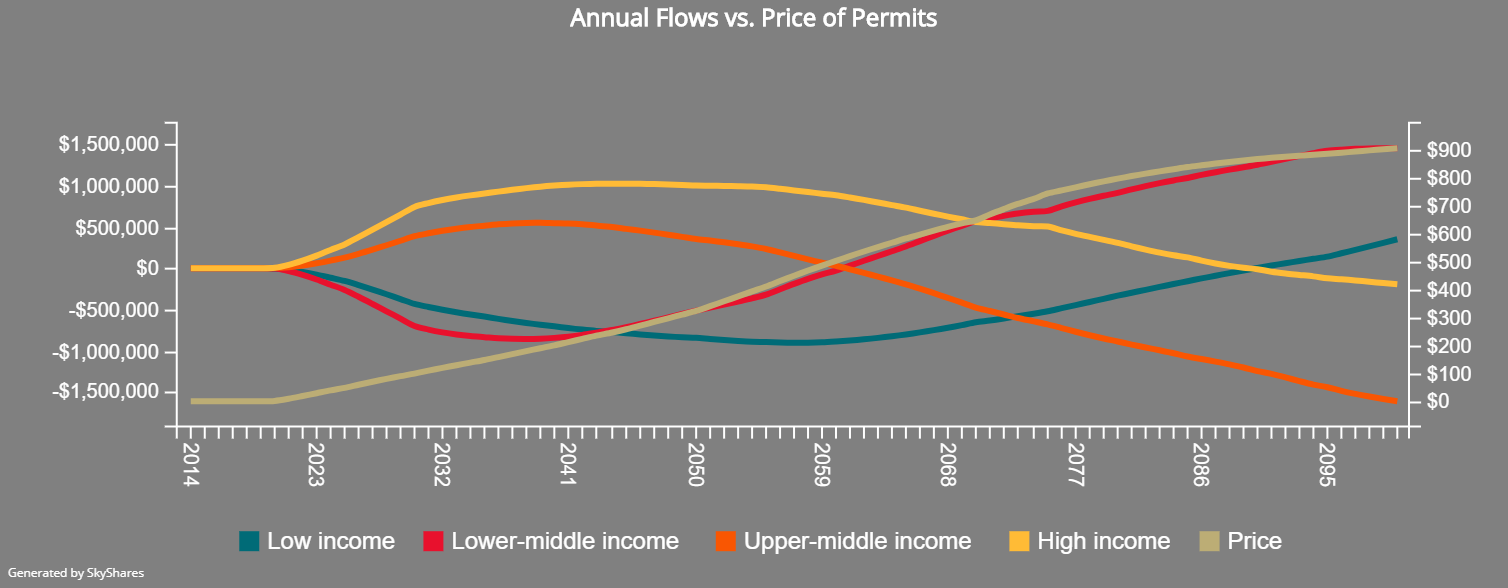

The market-clearing price of allowances is determined endogenously by matching supply and demand for abatement. SkyShares then maps back the equilibrium price to each country’s marginal abatement cost (MAC) curve to determine how much abatement each country provides at the world price. The rest is traded.

- Full trade: SkyShares determines the optimal mix of decarbonizing at home and of buying allowances on the market so as to minimize costs. There is a “no banking, no borrowing” rule and the market clears every year. This scenario is a cost-minimizing one.

- No trade: The user can turn trading off, and countries will be forced to meet their abatement target entirely through domestic emissions reduction.

- Regulation: The user can act as the central planner and mandate what share of the coalition’s abatement target must be decarbonized at home.

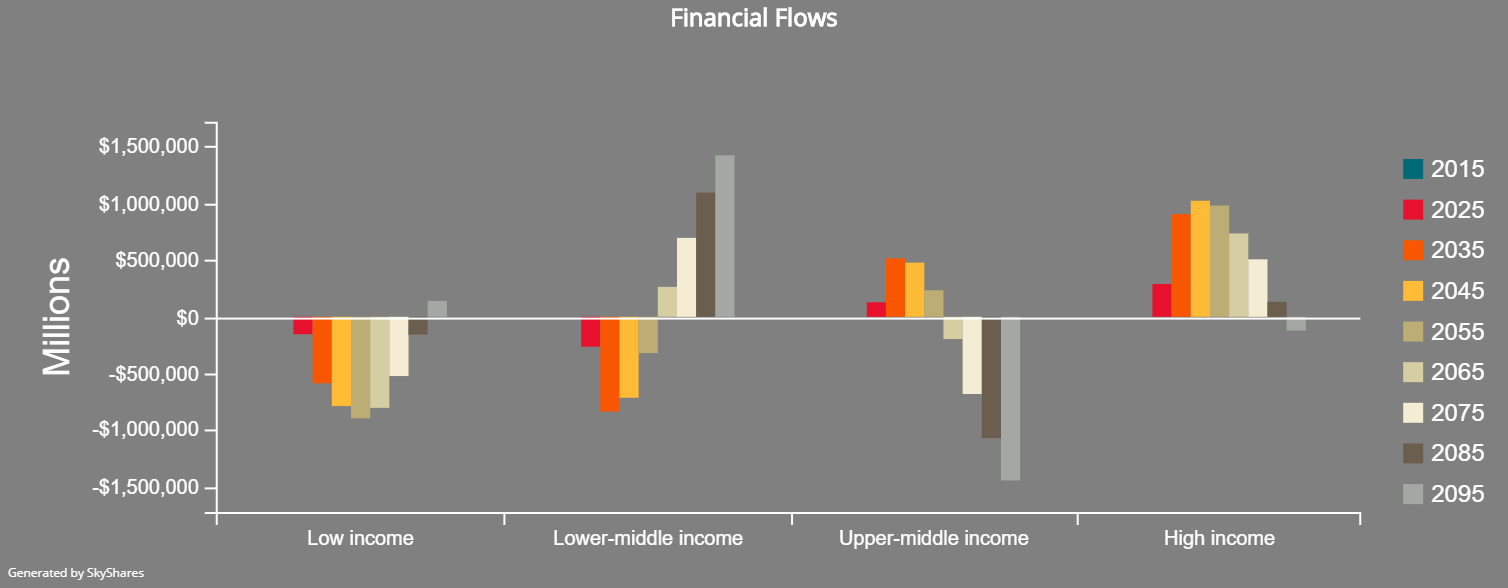

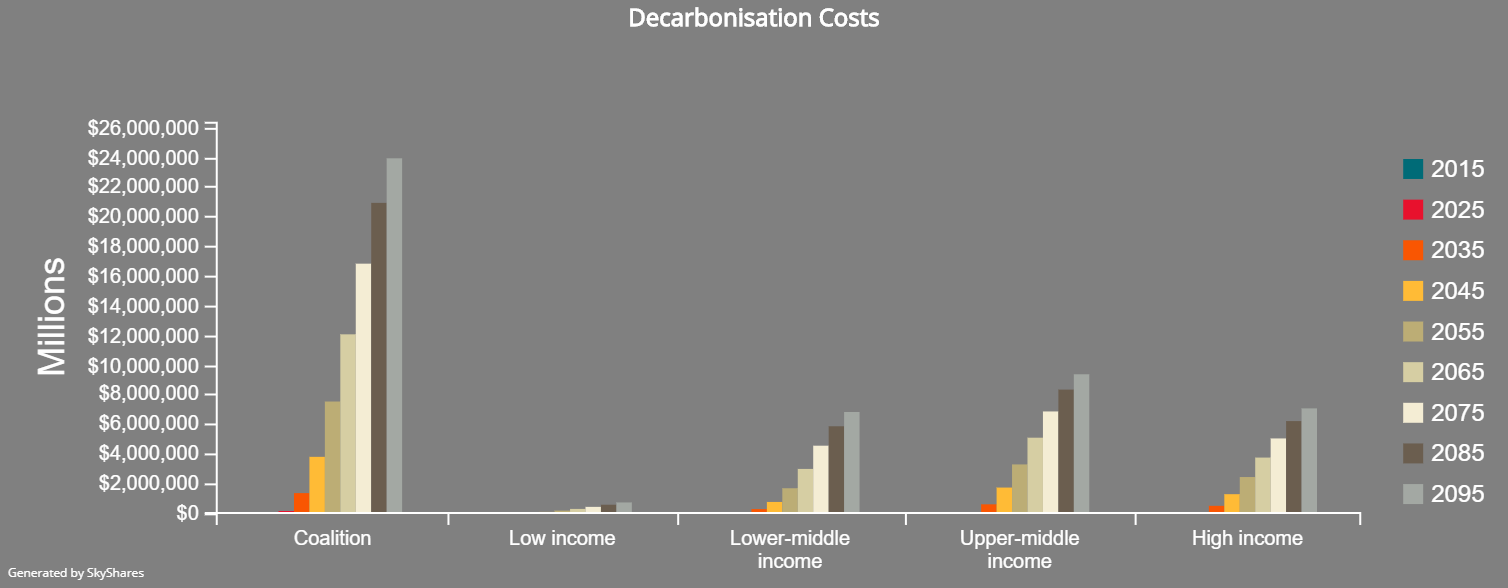

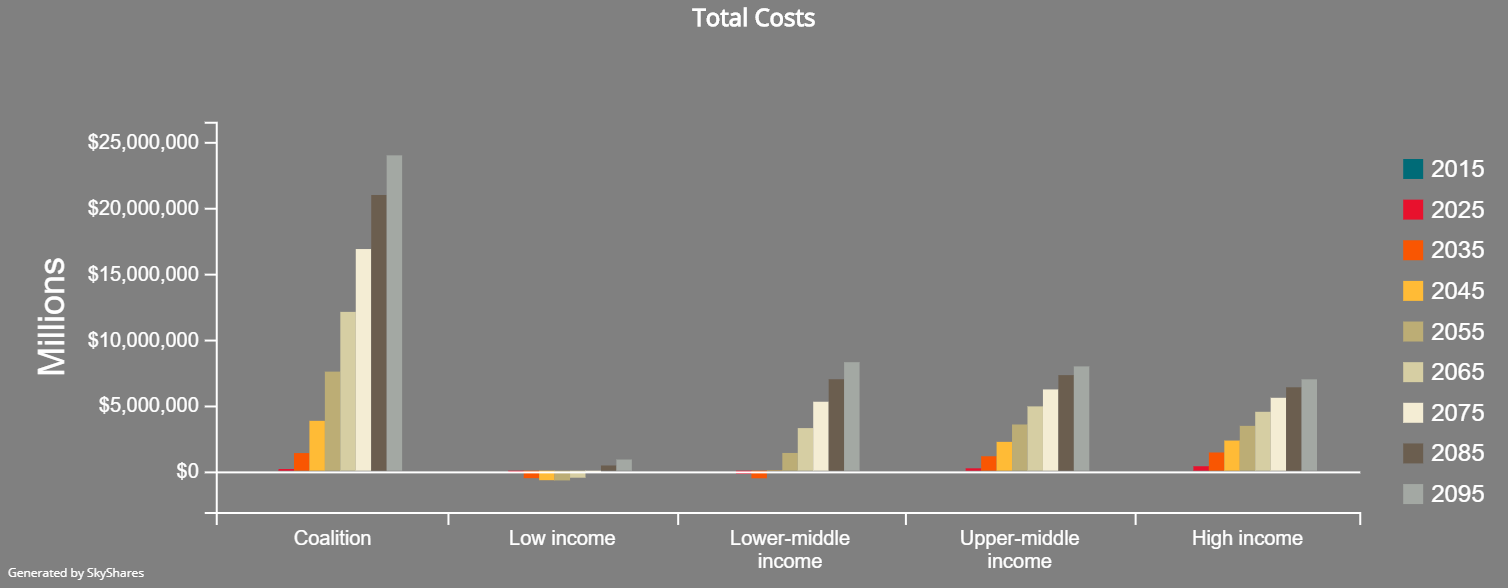

SkyShares computes the financial flows and decarbonization costs of each trading scenario for each country. Whatever scenario is chosen, the coalition will always stay within its carbon budget.

Results

My co-authors (Owen Barder and Alex Evans) and I have run SkyShares on what we call a Reference Scenario that we argue in this paper is a climate deal that will deliver the triple win of environmental sustainability, climate equity, and economic efficiency.

The Reference Scenario presumes all countries in the world join the coalition at the outset; sets a carbon budget consistent with a 50% likelihood of stabilizing temperature at 2°C; assumes mitigation starts early; allocates the emissions budget proportionally with a convergence to per capita shares in 2030; and allows full trading.

Our headline finding is that an approach based on fair shares of a global emissions budget is both affordable for higher emitting countries, and potentially game-changing as a source of finance for development for lower income countries if emissions trading is permitted.

In our Reference Scenario, we find that high income countries as a group would face net costs of only 0.56% of GDP a year in 2025 and 1.45% in 2030, rising to 2.97% by 2050. The United States would face net costs of 0.73% of GDP a year in 2025, and the European Union 0.30%.

On the other hand, lower emitting emerging economies would be net beneficiaries of the framework in early decades: India would gain 2.63% of GDP a year in 2025 and Brazil 0.50%, though they would then face net costs rather than benefits from around 2045 onwards.

Low income countries, finally, would stand to gain substantially in our Reference Scenario, given their very low per capita emissions. Ethiopia, for example, would stand to make 27.23% of its GDP a year by 2025, and Bangladesh 10.96%; low income countries as a group would gain 6.45% in 2025.

In dollar terms, the net financial flows to lower middle income countries would amount to $262.8 billion in 2025 (nearly twice as much as the $134.8 billion of total global Official Development Assistance flows in 2013), while those to LICs would total approximately $153 billion. This would therefore represent a major new source of finance for development and for delivering the Sustainable Development Goals.

The gallery below displays the emissions budget, allowances, transfers, financial flows, decarbonization costs, and total costs of the Reference Scenario.

Carbon pricing

Efficacy of carbon taxes

One of my research interests is the design of carbon pricing instruments in a second-best world. I have written about the pros and cons of cap-and-trade schemes versus carbon taxes.

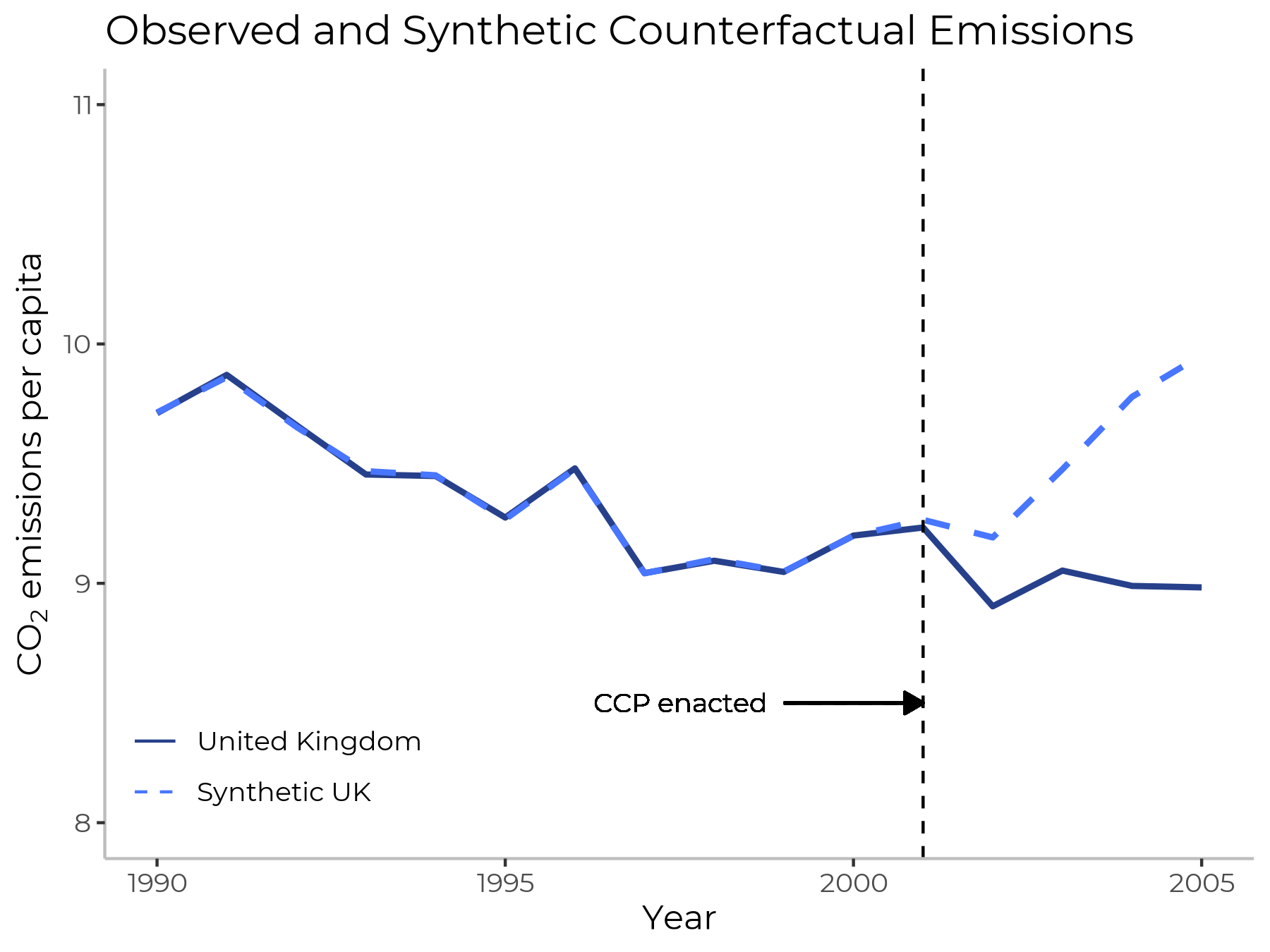

I have a paper with Matto Mildenberger in Climatic Change that evaluates the environmental effectiveness of a carbon pricing policy in the United Kingdom using synthetic control methods.

We construct a synthetic counterfactual by creating a weighted combination of countries that most closely resembled the UK before the policy was implemented. The figure below displays the emissions trajectories of the UK (solid line) and the synthetic UK (the dashed line). The causal impact of the policy is the difference between the two.

Backlash against carbon taxes

Carbon taxes are economically efficient in the sense that they offer the least-cost way to reduce emissions. Despite this, they have been the subject of intense political backlash, which decreases their appeal as a policy instrument for climate mitigation.

Colleagues and I have a working paper on this topic.

ESG

I won the S&P Global Academic ESG Research Award 2023 for the winning hypothesis on Climate Resilient Investment Strategies: Integrating future risks and opportunities from the physical impacts of climate change.