Table of Contents

Trade mis-invoicing in Africa¶

Policy and media attention on illicit financial flows (IFF) has increased, with the recognition that Africa is a net creditor to the world.

|

|

|

| New York Times (2013) | Guardian (2015) | |

|

| |

| Guardian (2017) | Economist (2019) |

What is trade mis-invoicing?

The deliberate mis-statement of price or quantity of internationally traded goods in invoices presented to customs

Can occur at import or export

Can result in an inflow or outflow of money

Motivations for trade mis-invoicing include:

Evading tariffs

Exploiting subsidy regimes

Subverting forex and capital controls

Hiding transfers of wealth

Mechanisms of mis-invoicing

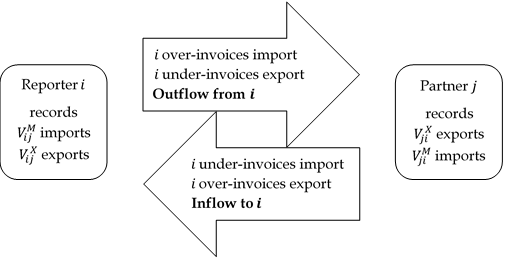

From the reporting country’s perspective, trade mis-invoicing can result in an inflow or an outflow of capital, and this can be achieved by misreporting the value of both imports and exports. Money can be moved out of the country by over-invoicing imports, where that country pays too much money to buy goods from its partner; or by under-invoicing exports, where that country does not charge enough money for the goods that it sells to its partner. Conversely, money can be illicitly routed in to that country by under-invoicing imports, where the country pays too little money to buy goods from its partner; or by over-invoicing exports, where the country charges too much for the goods that it sells to its partner. The direction of trade mis-invoicing in addition to its mechanisms is represented in the diagram below.

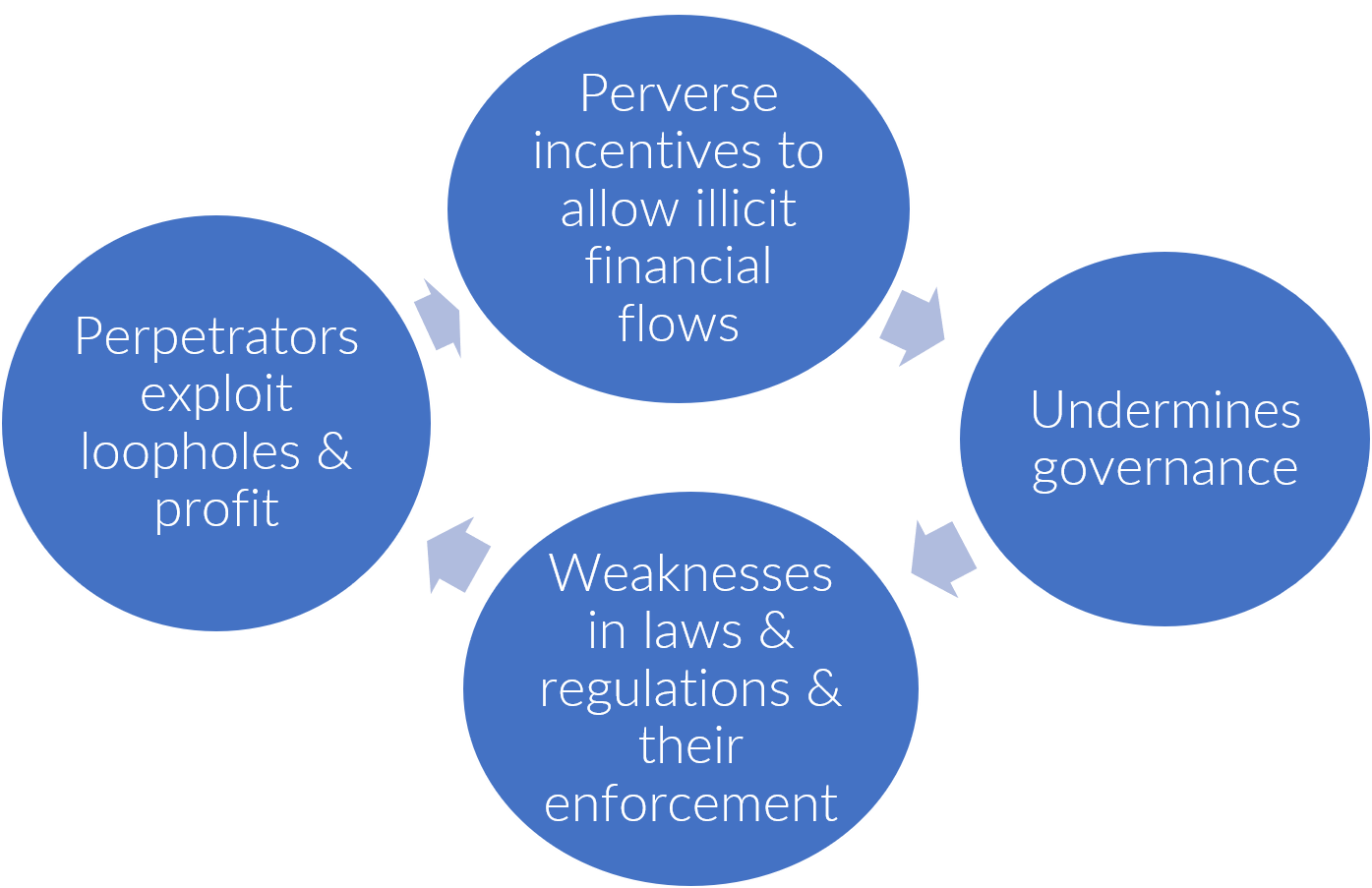

Why does trade mis-invoicing matter?

Outflows undermine the fiscal base and public spending

Financing gap needed to meet the Sustainable Development Goals (SDGs)

Combating trade mis-invoicing is crucial for the mobilization of domestic resources in the continent, and can catalyze sustainable development

|

| Governance loop (credit: William Davis) |

Data source

Trade mis-invoicing data-set of the United Nations Economic Commission for Africa

Panel with \(n=6,248,254\) of mis-invoiced trade between 179 reporting jurisdictions and 179 partner countries for years 2000-2016 and disaggregated commodities

Citation: Lépissier, Alice, Davis, William, & Ibrahim, Gamal. (2019). Trade Mis-Invoicing Dataset (Version 1).

The entire data-set

panel_results.Rdatawith ~6 million observations is available online.The unit of observation is a reporter-partner-commodity-year tuple, where the data represent the illicit flow embedded in a transaction between a reporter \(i\) and a partner \(j\) for a commodity \(c\) in year \(t\).

The full panel is ~2GB. This notebook works with smaller summary data-sets generated from the full panel. The code to generate these summary data-sets is available on the repository https://github.com/walice/Trade-IFF by running the script file

Compute IFF Estimates.R.

Nota bene: the figures in this notebook that are not generated here can be reconstructed by running the Data Visualization.R script in that same repository.

Methodology for calculating mis-invoiced trade

We locate mis-invoicing in the discrepancies between reported trade flows and their mirrored statistics

But not all observed discrepancies are due to illicit motives!

Imports tend to be recorded on the basis of Cost of Insurance and Freight (CIF), while exports are recorded Free On Board (FOB)

Our approach

Estimate the discrepancies between imports and mirror net exports as a function of both licit and illicit predictors

Perform a harmonization procedure in order to generate a reconciled value that represents our best estimate of what the legitimate value of the trade should be on a FOB basis

Calculate the IFF embedded in each transaction as the difference between the observed value and the reconciled value

What this data-set represents

The data-set presents estimates of mis-invoicing both in imports and exports. I will be working with the import data.

There is a low and a high variant of mis-invoicing estimates. Discussion of how they vary is beyond the scope of this project, but note that we will be working with the high variant exclusively, as those are the official numbers of UNECA.

A negative value represents an illicit inflow, while a positive value represents an illicit outflow.

The panel can be aggregated over several dimensions, e.g. partner country, commodity, year. There are two methods to aggregate up the illicit flow:

Net basis: simply add up all negative and positive values, so that inflows and outflows cancel each other out

Gross Excluding Reversals (GER) basis: ignore all inflows, and sum up the positive values only across trading partners

Aggregation strategy

It is important to note that for a given country pair \(i\) and \(j\) in a given year \(t\), the same trade flow can be associated with either an inflow or an outflow according to what commodity is traded. While it might seem unlikely that illicit funds might be traveling in both directions for the same trade flow, there could be a variety of different actors doing this for different reasons. For example, country \(i\) might have export taxes on raw materials and export subsidies for manufacturing output, which would give an incentive to under-invoice exports of raw materials (resulting in an illicit outflow) and to over-invoice exports of manufactured goods (resulting in an illicit inflow). Alternatively, a criminal syndicate that has a legitimate front company may use re-invoicing to send money to an affiliate in another country to make an investment (e.g. hiring “muscle” to fight off a competitor) and then bring funds back using exports to the same country when the investment bears fruit.

The object of analytical inquiry should guide the choice of aggregation strategy. For example, stakeholders interested in getting a picture of the total amount of funds departing a country on balance should favor a net aggregation basis. By contrast, stakeholders interested in better understanding the drivers and mechanisms of IFF should favor aggregation using GER in order to identify where money is flowing out or in.

In this project, I will be using unsupervised machine learning to extract insights on analytically relevant dimensions of variation, so I will use summary data-sets that have been aggregated on a Gross Excluding Reversals basis. In other words, I am more interested in the direction and topology of the illicit flows, rather than their magnitude.

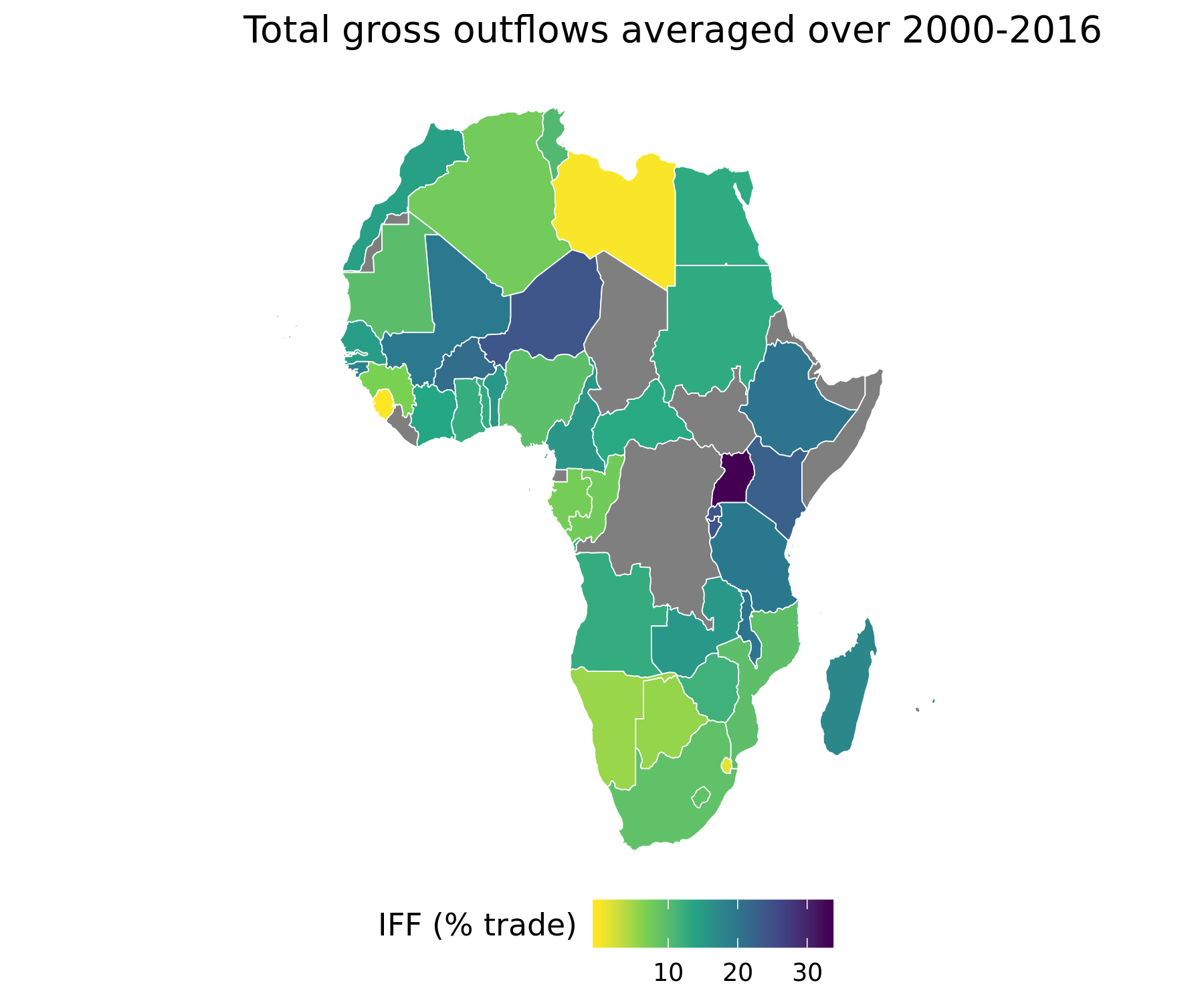

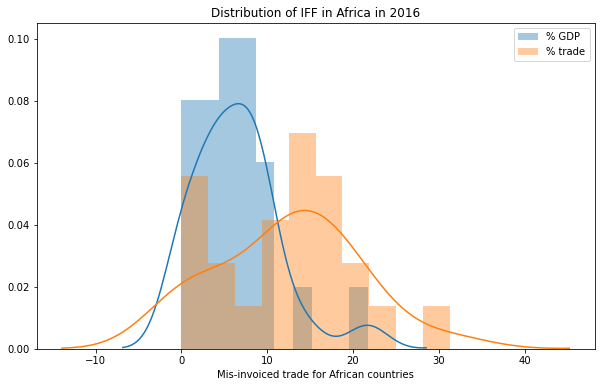

Zoom in on Africa

During 2000-2016, the continent lost on average $83 billion a year in gross illicit outflows

Net cumulative flows during that period were $362 billion

Source: generated by

Source: generated by Data Visualization.R in https://github.com/walice/Trade-IFF

Goals¶

While generating estimates of the dollar value of illicit trade has been helpful to shed light on the severity of the problem, the next step in the analysis is to further understand the nature of the illicit activity in terms of its origins, destinations, and sectors.

Therefore, the goal of this project is to extract meaningful insights on illicit trade using unsupervised machine learning techniques. By doing so, I can identify analytically relevant categories and dimensions of variation, in order to generate hypotheses and guide further work.

This project will apply the following techniques to the data:

Dimension reduction using Principal Components Analysis (PCA)

Clustering

Graph analysis

Data wrangling¶

I will work with two summary forms of the full data-set panel_results.Rdata: one where the data is aggregated up to the reporter country, and one where the dyadic nature of the data is preserved.

In the case where the data is aggregated up to the reporter country, there are two possible views of the feature space. On the one hand, the feature space can be spanned by the sectors of the different commodities (\(p=21\)). On the other hand, the feature space can be spanned by the reporter African countries (\(p=46\)).

Mis-invoiced trade for countries (aggregated data)

View 1: unit of observation = reporter-year; features = sectors

View 2: unit of observation = sector-year; features = reporters

Bilateral matrix of mis-invoiced trade (dyadic data)

Unit of observation = reporter-partner-year

Mis-invoiced trade data (for African reporting countries)¶

Let’s read in a summary data-set of the full panel which contains mis-invoicing estimates for reporter \(i\) in commodity \(c\) in year \(t\) (aggregated over partner countries \(j\) using the GER strategy).

IFF_Sector = pd.read_csv('Data/GER_Orig_Sect_Year_Africa.csv')

Let’s also extract the relevant labels for the countries in the data-set.

obs_info = IFF_Sector.reset_index().drop_duplicates(['reporter.ISO', 'year'])[['reporter.ISO',

'year',

'reporter',

'rIncome',

'rDev']]

obs_info = obs_info.replace({'LIC': 'Low income',

'LMC': 'Lower-middle income',

'UMC': 'Upper-middle income',

'HIC': 'High income'})

obs_info = obs_info.rename(columns={'rIncome': 'Income group (World Bank)',

'rDev': 'Country status (UN)'})

Mis-invoiced trade for countries by sectors

The table below displays the raw data of mis-invoiced trade for 46 African countries in 21 different sectors during 2000-2016, aggregated over partner countries.

| section | Imp_IFF_hi | ||

|---|---|---|---|

| reporter.ISO | year | ||

| DZA | 2001 | Animal and Animal Products | 1.914633e+08 |

| 2001 | Pulp of Wood or of Other Fibrous Material | 7.436143e+07 | |

| 2001 | Textiles | 3.560644e+07 | |

| 2001 | Footwear and Headgear | 1.146507e+06 | |

| 2001 | Stone, Glass, and Ceramics | 2.935880e+07 | |

| ... | ... | ... | ... |

| ZWE | 2007 | Arms and Ammunition | 0.000000e+00 |

| 2009 | Works of Art | 0.000000e+00 | |

| 2013 | Miscellaneous Manufactured Articles | 0.000000e+00 | |

| 2014 | Miscellaneous Manufactured Articles | 0.000000e+00 | |

| 2014 | Mineral Products | 0.000000e+00 |

11133 rows × 2 columns

Mis-invoiced trade data (bilateral trade matrix)¶

Now, let’s read in another summary data-set of the full panel which contains mis-invoicing estimates for reporter \(i\) with partner \(j\) in year \(t\) (aggregated over commodities \(c\) using the GER strategy).

IFF_Dest = pd.read_csv('Data/GER_Orig_Dest_Year_Africa.csv')

Mis-invoiced trade for dyads

The table below displays the raw data of mis-invoiced trade for 46 African countries with 167 partner countries during 2000-2016, aggregated over commodity sectors.

| partner.ISO | Imp_IFF_hi | ||

|---|---|---|---|

| reporter.ISO | year | ||

| DZA | 2001 | AND | 1.609561e+04 |

| 2001 | ARG | 4.717459e+07 | |

| 2001 | AUS | 2.027641e+07 | |

| 2001 | AUT | 7.641706e+07 | |

| 2001 | BEL | 2.285729e+07 | |

| ... | ... | ... | ... |

| ZWE | 2014 | MDG | 0.000000e+00 |

| 2014 | SGP | 0.000000e+00 | |

| 2014 | CHE | 0.000000e+00 | |

| 2014 | ARE | 0.000000e+00 | |

| 2015 | UGA | 0.000000e+00 |

34757 rows × 2 columns

Crosswalk data¶

Finally, let’s import a table that contains labels for the countries, such as their ISO codes, geographic regions, and income groupings that they belong to.

Metadata for countries

crosswalk = pd.read_excel("Data/crosswalk.xlsx").rename(columns={'Country': 'country'})

crosswalk.head()

| ISO3166.3 | ISO3166.2 | country | UN_Region | UN_Region_Code | UN_Sub-region | UN_Sub-region_Code | UN_Intermediate_Region | UN_Intermediate_Region_Code | UN_M49_Code | ... | WB_Income_Group_Code | WB_Region | WB_Lending_Category | WB_Other | OECD | EU28 | Arab League | Commonwealth | Longitude | Latitude | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | ABW | AW | Aruba | Americas | 19.0 | Latin America and the Caribbean | 419.0 | Caribbean | 29.0 | 533.0 | ... | HIC | Latin America and Caribbean | .. | NaN | 0 | 0 | 0 | 0 | -69.982677 | 12.520880 |

| 1 | AFG | AF | Afghanistan | Asia | 142.0 | Southern Asia | 34.0 | NaN | NaN | 4.0 | ... | LIC | South Asia | IDA | HIPC | 0 | 0 | 0 | 0 | 66.004734 | 33.835231 |

| 2 | AFG | AF | Afghanistan, Islamic Republic of | Asia | 142.0 | Southern Asia | 34.0 | NaN | NaN | 4.0 | ... | LIC | South Asia | IDA | HIPC | 0 | 0 | 0 | 0 | 66.004734 | 33.835231 |

| 3 | AGO | AO | Angola | Africa | 2.0 | Sub-Saharan Africa | 202.0 | Middle Africa | 17.0 | 24.0 | ... | LMC | Sub-Saharan Africa | IBRD | NaN | 0 | 0 | 0 | 0 | 17.537368 | -12.293361 |

| 4 | AIA | AI | Anguila | Americas | 19.0 | Latin America and the Caribbean | 419.0 | Caribbean | 29.0 | 660.0 | ... | NaN | NaN | NaN | NaN | 0 | 0 | 0 | 0 | -63.064989 | 18.223959 |

5 rows × 25 columns

Auxiliary functions¶

I create three auxiliary functions to aid me in running Principal Component Analysis:

A function which creates the feature space for PCA from a data-set in a long format (which is the format of

IFF_SectorandIFF_Dest)A function which runs PCA and plots a biplot for two chosen principal components

A function which plots a cumulative scree plot

def create_features(data, values, features, obs):

"""

Convert data-set in long format to wide and preserve information on year.

data: {IFF_Sector_Imp, IFF_Dest_Imp, IFF_Dest_AFR, ...}, as Pandas dataframe,

name of data-set from which to create feature space, must be in long format

values: {'Imp_IFF_hi', 'Exp_IFF_hi'}, as string, values that data-set will represent

features: {'reporter.ISO', 'section', 'partner.ISO'}, as string,

what to use as the feature space

obs: {'section', 'reporter.ISO'}, as string, what to use as the observation level

"""

features_data = data.pivot_table(values=values,

columns=features,

index=[obs, 'year'],

fill_value=0)

return features_data

# Extra function to run the analysis on average mis-invoicing over the years

def create_features_mean(data, values, features, obs):

"""

Convert data-set in long format to wide.

data: {IFF_Sector_mean, IFF_Dest_mean, ...}, as Pandas dataframe,

name of data-set from which to create feature space, must be in long format

values: {'Imp_IFF_hi', 'Exp_IFF_hi'}, as string, values that data-set will represent

features: {'reporter.ISO', 'section', 'partner.ISO'}, as string,

what to use as the feature space

obs: {'section', 'reporter.ISO'}, as string, what to use as the observation level

"""

features_data = data.pivot_table(values=values,

columns=features,

index=obs,

fill_value=0)

return features_data

def biplot_PCA(features_data, nPC=2, firstPC=1, secondPC=2, obs='reporter.ISO', show_loadings=False):

"""

Project the data in the 2-dimensional space spanned by 2 principal components

chosen by the user, along with a bi-plot of the top 3 loadings per PC, and color observations

by class label.

Args:

features_data: as Pandas dataframe, data-set of features

nPC: number of principal components

firstPC: integer denoting first principal component to plot in bi-plot

secondPC: integer denoting second principal component to plot in bi-plot

obs: string denoting index of class labels (in features_data)

show_loadings: Boolean indicating whether PCA loadings should be displayed

Returns:

plot (interactive)

pca_loadings (if show_loadings=True)

"""

# Run PCA (standardize data beforehand)

features_data_std = StandardScaler().fit_transform(features_data)

pca = PCA(n_components=nPC, random_state=234)

princ_comp = pca.fit_transform(features_data_std)

# Extract PCA loadings

cols = ['PC' + str(c+1) for c in np.arange(nPC)]

pca_loadings = pd.DataFrame(pca.components_.T,

columns=cols,

index=list(features_data.columns))

# Extract PCA scores

pca_scores = pd.DataFrame(princ_comp,

columns=cols)

pca_scores[obs] = features_data.reset_index()[obs].values.tolist()

pca_scores['year'] = features_data.reset_index()['year'].values.tolist()

score_PC1 = princ_comp[:,firstPC-1]

score_PC2 = princ_comp[:,secondPC-1]

# Generate plot data

if obs == 'reporter.ISO':

plot_data = pd.merge(pca_scores, obs_info, on=[obs, 'year'])

color_obs = 'reporter'

tooltip_obs = ['reporter', 'year', 'Income group (World Bank)', 'Country status (UN)']

else:

plot_data = pca_scores

color_obs = 'section'

tooltip_obs = ['section', 'year']

# Return chosen PCs to plot

PC1 = 'PC'+str(firstPC)

PC2 = 'PC'+str(secondPC)

# Extract top loadings (in absolute value)

# TO DO: use dict to iterate over

toploadings_PC1 = pca_loadings.apply(lambda x: abs(x)).sort_values(by=PC1).tail(3)[[PC1, PC2]]

toploadings_PC2 = pca_loadings.apply(lambda x: abs(x)).sort_values(by=PC2).tail(3)[[PC1, PC2]]

originsPC1 = pd.DataFrame({'index':toploadings_PC1.index.tolist(),

PC1: np.zeros(3),

PC2: np.zeros(3)})

originsPC2 = pd.DataFrame({'index':toploadings_PC2.index.tolist(),

PC1: np.zeros(3),

PC2: np.zeros(3)})

toploadings_PC1 = pd.concat([toploadings_PC1.reset_index(), originsPC1], axis=0)

toploadings_PC2 = pd.concat([toploadings_PC2.reset_index(), originsPC2], axis=0)

toploadings_PC1[PC1] = toploadings_PC1[PC1]*max(score_PC1)*1.5

toploadings_PC1[PC2] = toploadings_PC1[PC2]*max(score_PC2)*1.5

toploadings_PC2[PC1] = toploadings_PC2[PC1]*max(score_PC1)*1.5

toploadings_PC2[PC2] = toploadings_PC2[PC2]*max(score_PC2)*1.5

# Project top 3 loadings over the space spanned by 2 principal components

lines = alt.Chart().mark_line().encode()

for color, i, dataset in zip(['#440154FF', '#21908CFF'], [0,1], [toploadings_PC1, toploadings_PC2]):

lines[i] = alt.Chart(dataset).mark_line(color=color).encode(

x= PC1 +':Q',

y= PC2 +':Q',

detail='index'

).properties(

width=400,

height=400

)

# Add labels to the loadings

text=alt.Chart().mark_text().encode()

for color, i, dataset in zip(['#440154FF', '#21908CFF'], [0, 1], [toploadings_PC1[0:3], toploadings_PC2[0:3]]):

text[i] = alt.Chart(dataset).mark_text(

align='left',

baseline='bottom',

color=color

).encode(

x= PC1 +':Q',

y= PC2 +':Q',

text='index'

)

# Scatter plot colored by observation class label

points = alt.Chart(plot_data).mark_circle(size=60).encode(

x=alt.X(PC1, axis=alt.Axis(title='Principal Component ' + str(firstPC))),

y=alt.X(PC2, axis=alt.Axis(title='Principal Component ' + str(secondPC))),

color=alt.Color(color_obs, scale=alt.Scale(scheme='category20b'),

legend=alt.Legend(orient='right')),

tooltip=tooltip_obs

).interactive()

# Bind it all together

chart = (points + lines[0] + lines[1] + text[0] + text[1])

chart.display()

if show_loadings:

return pca_loadings

def scree_plot(features_data, show_explained_var=False):

"""

Create a cumulative scree splot and (optional) return the explained variance by each component.

features_data: as Pandas dataframe, the data-set on which to run PCA

show_explained_var: as Boolean, flag for whether to return explained variance

"""

features_data_std = StandardScaler().fit_transform(features_data)

pca = PCA(n_components=features_data_std.shape[1], random_state=234)

princ_comp = pca.fit_transform(features_data_std)

explained_var = pd.DataFrame({'PC': np.arange(1,features_data_std.shape[1]+1),

'var': pca.explained_variance_ratio_,

'cumvar': np.cumsum(pca.explained_variance_ratio_)})

# Adapted from https://altair-viz.github.io/gallery/multiline_tooltip.html

# Create a selection that chooses the nearest point & selects based on x-value

nearest = alt.selection(type='single', nearest=True, on='mouseover',

fields=['PC'], empty='none')

# The basic line

line = alt.Chart(explained_var).mark_line(interpolate='basis', color='#FDE725FF').encode(

alt.X('PC:Q',

scale=alt.Scale(domain=(1, len(explained_var))),

axis=alt.Axis(title='Principal Component')

),

alt.Y('cumvar:Q',

scale=alt.Scale(domain=(min(explained_var['cumvar']), 1)),

axis=alt.Axis(title='Cumulative Variance Explained')

),

)

# Transparent selectors across the chart. This is what tells us

# the x-value of the cursor

selectors = alt.Chart(explained_var).mark_point().encode(

x='PC:Q',

opacity=alt.value(0),

).add_selection(

nearest

)

# Draw points on the line, and highlight based on selection

points = line.mark_point().encode(

opacity=alt.condition(nearest, alt.value(1), alt.value(0))

)

# Draw text labels near the points, and highlight based on selection

text = line.mark_text(align='left', dx=5, dy=-5).encode(

text=alt.condition(nearest, 'cumvar:Q', alt.value(' '))

)

# Draw a rule at the location of the selection

rules = alt.Chart(explained_var).mark_rule(color='gray').encode(

x='PC:Q',

).transform_filter(

nearest

)

# Put the five layers into a chart and bind the data

out = alt.layer(

line, selectors, points, rules, text

).properties(

title='Cumulative scree plot',

width=500, height=300

)

out.display()

if show_explained_var:

return explained_var[['PC', 'var']]

PCA on feature space (for individual reporting countries)¶

I now run PCA on the data-set IFF_Sector which includes mis-invoiced trade for a country \(i\) in commodity \(c\) in year \(t\).

Sector features¶

One possible view of IFF_Sector is to view the sectors as the feature space where \(p=21\). Therefore, I use the function create_features() to generate the data-set to be used in PCA analysis.

sector_features = create_features(IFF_Sector_Imp, 'Imp_IFF_hi',

features='section', obs='reporter.ISO')

sector_features

| section | Animal and Animal Products | Animal or Vegetable Fats and Oils | Arms and Ammunition | Base Metals | Chemicals and Allied Industries | Footwear and Headgear | Machinery and Electrical | Mineral Products | Miscellaneous Manufactured Articles | Pearls, Precious Stones and Metals | ... | Precision Instruments | Prepared Foodstuffs | Pulp of Wood or of Other Fibrous Material | Raw Hides, Skins, Leather, and Furs | Stone, Glass, and Ceramics | Textiles | Transportation | Vegetable Products | Wood and Wood Products | Works of Art | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| reporter.ISO | year | |||||||||||||||||||||

| AGO | 2009 | 2.694946e+08 | 7.652455e+07 | 67738.261242 | 1.025920e+09 | 5.115176e+08 | 2.920410e+07 | 1.525512e+09 | 1.727293e+09 | 2.472936e+08 | 5.575633e+05 | ... | 1.242156e+08 | 4.781184e+08 | 1.149992e+08 | 1.097769e+07 | 1.349018e+08 | 1.827787e+08 | 2.198838e+09 | 4.249722e+08 | 4.337043e+07 | 177640.929155 |

| 2010 | 2.064906e+08 | 7.311396e+07 | 0.000000 | 9.989842e+08 | 2.575443e+08 | 7.853065e+06 | 1.308337e+09 | 2.953387e+09 | 8.404302e+07 | 3.209177e+05 | ... | 1.115183e+08 | 2.342889e+08 | 7.332134e+07 | 4.013044e+06 | 7.601278e+07 | 8.285704e+07 | 9.611656e+08 | 1.959128e+08 | 2.310136e+07 | 404828.231824 | |

| 2011 | 2.995594e+08 | 8.058180e+07 | 89365.880480 | 6.689511e+08 | 2.931591e+08 | 1.172881e+07 | 1.389743e+09 | 2.286539e+09 | 4.413341e+07 | 9.645181e+05 | ... | 1.418956e+08 | 3.159980e+08 | 9.911835e+07 | 9.995669e+06 | 6.607126e+07 | 7.912925e+07 | 7.070474e+08 | 3.734589e+08 | 1.363601e+07 | 586586.948365 | |

| 2012 | 7.103770e+08 | 2.746924e+08 | 261265.895948 | 1.753970e+09 | 8.540407e+08 | 3.823724e+07 | 2.790368e+09 | 9.203666e+08 | 1.763904e+08 | 1.271289e+06 | ... | 2.073111e+08 | 1.025668e+09 | 2.641831e+08 | 1.394356e+07 | 1.630307e+08 | 1.683128e+08 | 1.975553e+09 | 6.541154e+08 | 3.980884e+07 | 739122.050820 | |

| 2013 | 4.031560e+08 | 1.541679e+08 | 188343.533148 | 9.230300e+08 | 4.793908e+08 | 1.212363e+07 | 1.428283e+09 | 2.009915e+09 | 4.871315e+07 | 6.250082e+05 | ... | 1.063123e+08 | 4.931687e+08 | 1.798533e+08 | 8.930246e+06 | 7.882264e+07 | 7.858108e+07 | 4.962937e+09 | 3.995114e+08 | 1.836680e+07 | 418841.640492 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| ZWE | 2011 | 3.098093e+07 | 6.060789e+07 | 9124.882478 | 1.693777e+08 | 2.260227e+09 | 2.817909e+06 | 3.231869e+08 | 2.747704e+08 | 9.872441e+06 | 3.618592e+06 | ... | 2.136919e+07 | 1.144497e+08 | 5.855387e+07 | 6.259512e+05 | 2.652474e+07 | 4.726781e+07 | 8.963644e+08 | 1.874874e+08 | 6.016952e+06 | 35481.251510 |

| 2012 | 2.784481e+07 | 5.549232e+07 | 856.631347 | 1.085453e+08 | 4.929549e+08 | 7.015919e+06 | 3.451931e+08 | 1.461844e+08 | 1.510668e+07 | 2.876014e+05 | ... | 3.162707e+07 | 2.025934e+08 | 6.024629e+07 | 1.412797e+06 | 2.482629e+07 | 5.147542e+07 | 9.468142e+08 | 1.900125e+08 | 7.901902e+06 | 59677.045599 | |

| 2013 | 0.000000e+00 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | ... | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000 | |

| 2014 | 0.000000e+00 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | ... | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000 | |

| 2015 | 1.458046e+07 | 7.135043e+07 | 19192.507302 | 8.703951e+07 | 2.299085e+08 | 4.468801e+06 | 3.437244e+08 | 1.401916e+08 | 2.432263e+07 | 3.672531e+07 | ... | 3.233606e+07 | 3.778318e+07 | 3.157795e+07 | 1.061420e+06 | 1.724449e+07 | 2.841926e+07 | 2.137692e+08 | 1.585549e+08 | 4.569325e+06 | 6305.070602 |

624 rows × 21 columns

Biplots¶

The figure below displays a biplot of the first 2 principal components, in addition to reporting the loadings for all principal components in the following table.

biplot_PCA(sector_features, 10, 1, 2, obs='reporter.ISO', show_loadings=True)

| PC1 | PC2 | PC3 | PC4 | PC5 | PC6 | PC7 | PC8 | PC9 | PC10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Animal and Animal Products | 0.223097 | -0.285686 | -0.052218 | 0.200337 | 0.280789 | -0.075192 | -0.159824 | 0.157986 | -0.133621 | 0.067581 |

| Animal or Vegetable Fats and Oils | 0.145805 | -0.041750 | 0.262100 | -0.281551 | -0.378544 | -0.470151 | 0.409970 | 0.471670 | 0.177591 | -0.031639 |

| Arms and Ammunition | 0.030559 | -0.044358 | 0.524677 | -0.654182 | 0.434354 | 0.055627 | -0.201368 | -0.113006 | -0.079142 | -0.115541 |

| Base Metals | 0.235966 | -0.206534 | -0.261180 | -0.147777 | -0.019680 | -0.153272 | 0.017922 | -0.247084 | 0.174715 | -0.069873 |

| Chemicals and Allied Industries | 0.271238 | 0.107591 | -0.117222 | -0.089472 | -0.096976 | -0.130645 | -0.071165 | -0.219172 | -0.198166 | 0.036517 |

| Footwear and Headgear | 0.206357 | 0.378112 | 0.015170 | -0.019961 | -0.001383 | -0.029500 | -0.042735 | 0.010544 | 0.026510 | -0.252435 |

| Machinery and Electrical | 0.272101 | 0.160466 | 0.076229 | 0.091921 | -0.067637 | -0.159494 | 0.022549 | -0.135941 | -0.157103 | -0.115312 |

| Mineral Products | 0.238785 | 0.071925 | -0.098357 | -0.201011 | -0.166463 | 0.073908 | -0.133348 | 0.121464 | -0.241190 | 0.675042 |

| Miscellaneous Manufactured Articles | 0.246123 | 0.283544 | 0.122775 | 0.033592 | -0.049743 | -0.014818 | -0.017630 | 0.069480 | -0.247438 | -0.043076 |

| Pearls, Precious Stones and Metals | 0.060193 | 0.251657 | -0.373387 | -0.153599 | 0.567863 | 0.055855 | 0.647708 | 0.088517 | -0.049224 | 0.089860 |

| Plastics and Rubbers | 0.264093 | -0.144764 | 0.124109 | 0.236111 | 0.112342 | 0.023331 | 0.062706 | 0.076398 | 0.119468 | -0.076649 |

| Precision Instruments | 0.223754 | 0.362288 | -0.013533 | 0.023957 | -0.084425 | -0.090796 | -0.080419 | -0.186415 | -0.262231 | -0.078130 |

| Prepared Foodstuffs | 0.252722 | -0.227483 | -0.012139 | 0.160146 | 0.177798 | -0.024717 | -0.088546 | 0.289203 | -0.187744 | -0.058613 |

| Pulp of Wood or of Other Fibrous Material | 0.272304 | -0.112890 | -0.010570 | 0.074023 | 0.024044 | -0.016865 | 0.003323 | -0.123810 | 0.135842 | 0.200798 |

| Raw Hides, Skins, Leather, and Furs | 0.206454 | 0.084348 | 0.178427 | 0.121865 | -0.101317 | 0.619649 | 0.102592 | 0.287981 | -0.057302 | -0.251296 |

| Stone, Glass, and Ceramics | 0.225603 | 0.111290 | 0.264504 | 0.269760 | 0.061210 | -0.018303 | 0.176815 | -0.368090 | 0.400752 | -0.018317 |

| Textiles | 0.209936 | -0.103101 | -0.054321 | -0.264334 | -0.273480 | 0.542184 | 0.126078 | -0.076346 | 0.216014 | 0.139611 |

| Transportation | 0.238443 | -0.119628 | 0.256225 | 0.081261 | 0.184539 | -0.059237 | 0.015553 | -0.095856 | 0.219874 | 0.334486 |

| Vegetable Products | 0.245486 | -0.284943 | -0.122225 | -0.029458 | 0.071482 | -0.036325 | -0.074223 | 0.202113 | -0.106308 | -0.240274 |

| Wood and Wood Products | 0.201178 | -0.222154 | -0.377723 | -0.300290 | -0.132165 | 0.007197 | -0.048891 | -0.185469 | 0.074259 | -0.351532 |

| Works of Art | 0.089055 | 0.388758 | -0.239308 | -0.078967 | 0.157495 | -0.041382 | -0.486227 | 0.369405 | 0.561157 | 0.018339 |

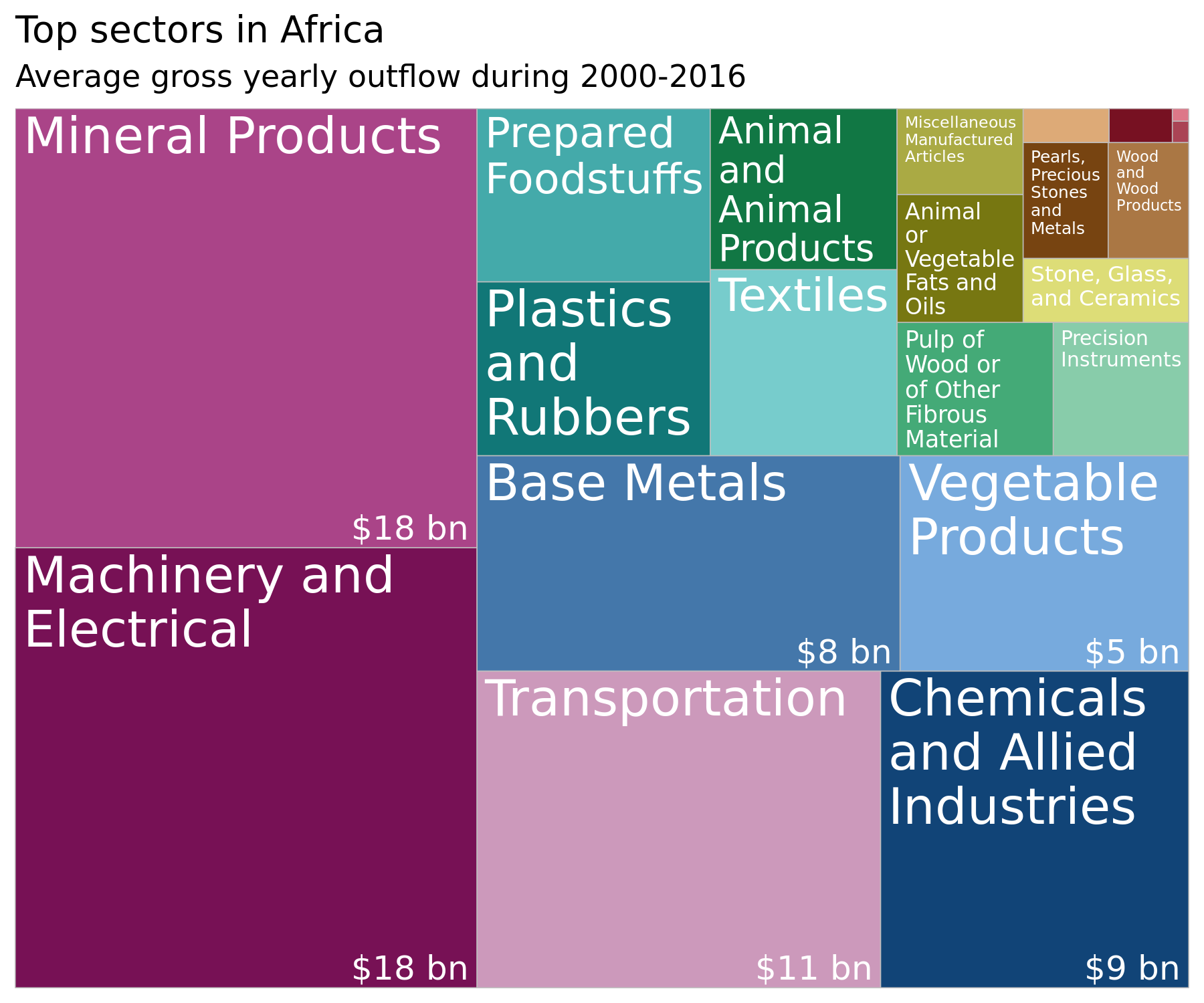

The first two principal components can be interpreted as recovering variation in the size of the illicit flow. The top loadings on the first principal component include Machinery and Electrical, and Chemicals and Allied Industries, which are the sectors with the highest amount of mis-invoiced trade. The treemap figure below represents the average gross yearly outflow to different sectors in Africa, and we can see that the aforementioned sectors account for a large chunk of that.

By contrast, the loadings on the second component are associated with sectors which are specialized, precision sectors that do not account for a large amount of mis-invoicing, compared to others. Indeed, Works of Art, and Footwear and Headgear are in the top-right corner of the treemap figure (and do not even appear with labels as they are so small).

Thus, it seems like the magnitude of the trade mis-invoicing (in dollar values) explains the highest variability in the data.

Source: generated by

Source: generated by Data Visualization.R in https://github.com/walice/Trade-IFF

biplot_PCA(sector_features, 10, 3, 4, obs='reporter.ISO')

The sixth principal component (displayed in the figure below) captures variation with respect to the natural origin of the commodity being traded and its functional use. The top loadings include sectors where the commodity is generated from natural resources (e.g. animals or vegetables) and which is functionally used in clothing, cooking, and cosmetics (e.g. textiles, leathers, oils).

biplot_PCA(sector_features, 10, 5, 6, obs='reporter.ISO')

Explained variance¶

The first 6 principal components examined above explain 83% of the variance in the data. The first principal component, which captures magnitude of the flow, accounts of 52% of the variance alone.

scree_plot(sector_features, show_explained_var=True)

| PC | var | |

|---|---|---|

| 0 | 1 | 0.524988 |

| 1 | 2 | 0.121415 |

| 2 | 3 | 0.054159 |

| 3 | 4 | 0.049898 |

| 4 | 5 | 0.042107 |

| 5 | 6 | 0.041007 |

| 6 | 7 | 0.036014 |

| 7 | 8 | 0.028847 |

| 8 | 9 | 0.024146 |

| 9 | 10 | 0.018279 |

| 10 | 11 | 0.012558 |

| 11 | 12 | 0.009987 |

| 12 | 13 | 0.007011 |

| 13 | 14 | 0.006890 |

| 14 | 15 | 0.005213 |

| 15 | 16 | 0.004848 |

| 16 | 17 | 0.004001 |

| 17 | 18 | 0.002819 |

| 18 | 19 | 0.002489 |

| 19 | 20 | 0.001800 |

| 20 | 21 | 0.001524 |

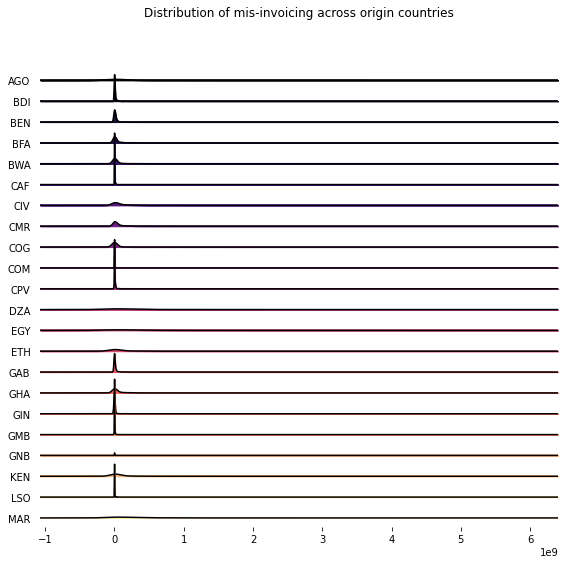

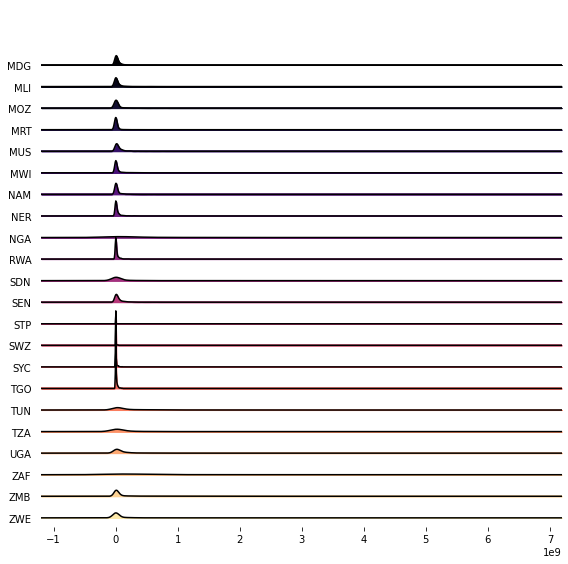

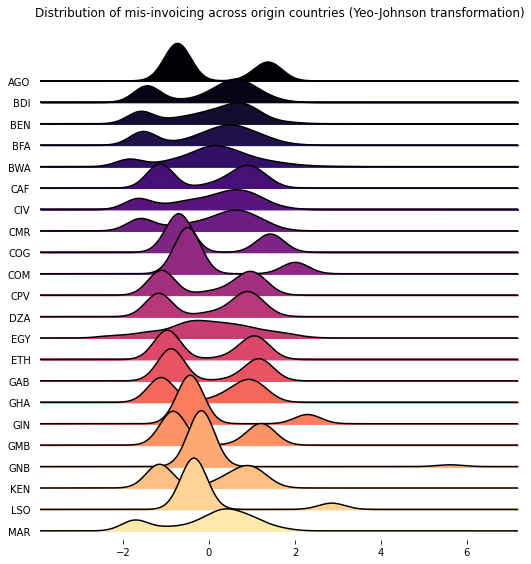

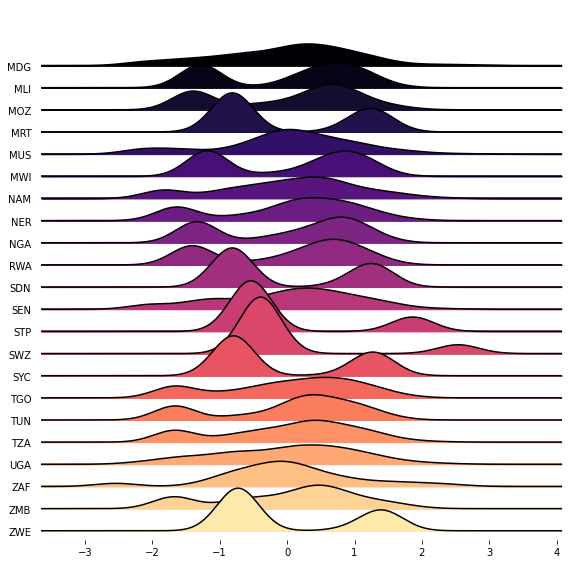

Variance-stabilizing and normalizing transformations¶

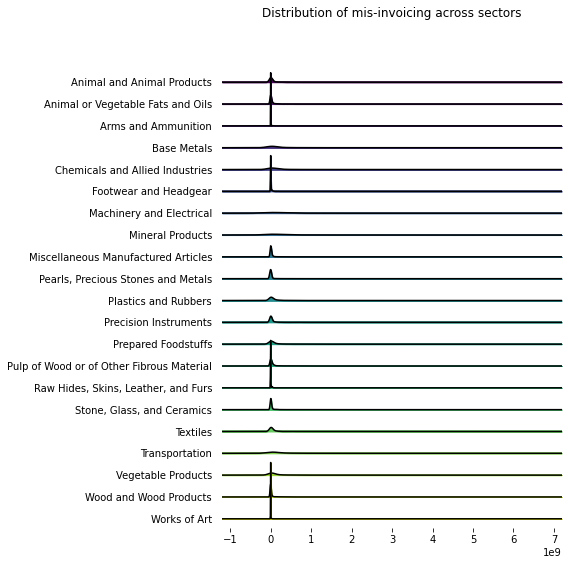

The figure below displays the distribution of mis-invoicing for the 21 different sectors. It is heavily right-skewed across all sectors, with very few high-value mis-invoiced transactions.

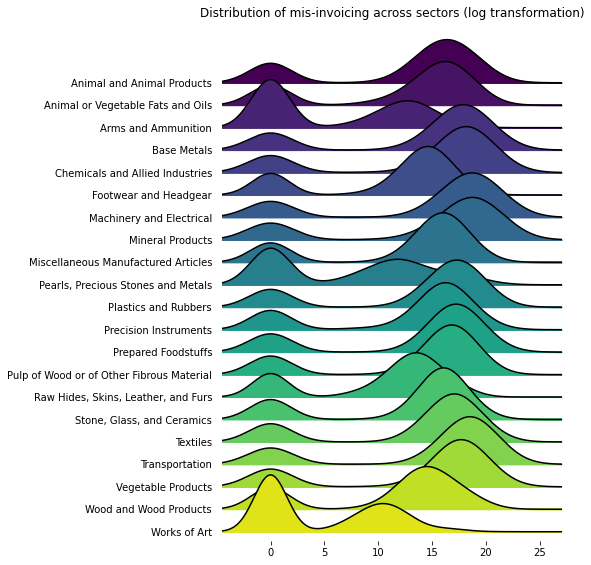

I explore two possible transformations of the data: a (modified) log transformation and a Yeo–Johnson. The values of the data-set are all non-negative, with some values equal to 0. Therefore, the figure below displays the distribution of the data after taking \(log(x+1)\).

sector_features_log = sector_features.apply(lambda x: np.log(x+1) if np.issubdtype(x.dtype, np.number) else x, axis=0)

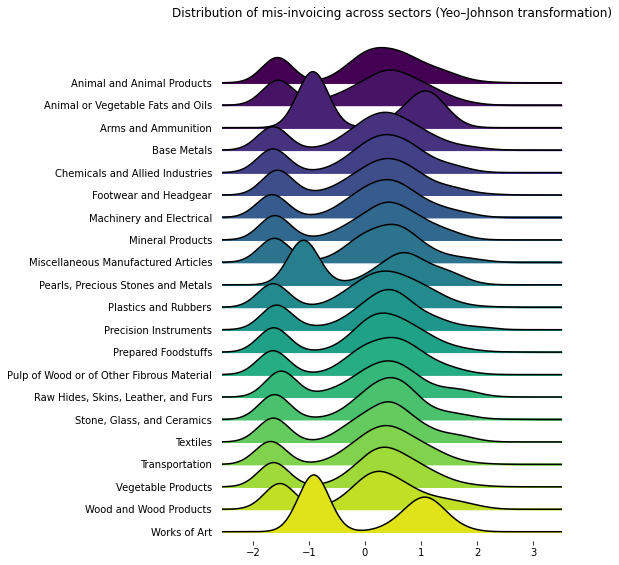

The Yeo-Johnson transformation is similar to a Box-Cox transformation, but allows for zero values. When \(x=0\) and the tuning parameter \(\lambda=0\), it will apply the same modified log transformation, \(log(x=1)\), as described above.

sector_features_yeo = power_transform(sector_features, method='yeo-johnson', standardize=True)

sector_features_yeo = pd.DataFrame(sector_features_yeo,

index=sector_features.index,

columns=sector_features.columns)

fig, axes = joypy.joyplot(sector_features_yeo, colormap=plt.cm.viridis, figsize=(8,8),

title='Distribution of mis-invoicing across sectors (Yeo–Johnson transformation)');

The two figures below display the results of running the PCA analysis on transformations of the data using a modified log and a Yeo-Johnson transformation, respectively.

The top loadings on the second principal component are the same and refer to Works of Art, Pearls, Precious Stones and Metals, and Arms and Ammunitions. These sectors refer to extremely high value-added sectors where the traded commodity is a finished product.

By contrast, the loadings on the first principal component (in either transformation) refer to heavy industries, where the commodity is an intermediate product (as opposed to a finished product). Even after applying normalizing transformations, the first principal component recovers sectors which were responsible for a large amount of the dollar value of mis-invoicing in the continent during 2000-2016.

biplot_PCA(sector_features_log, 10, 1, 2, obs='reporter.ISO')

biplot_PCA(sector_features_yeo, 10, 1, 2, obs='reporter.ISO')

Finally, transforming the data improves the performance of the PCA analysis, in the sense that the first two principal components now explain 90% of the variance in the data.

scree_plot(sector_features_yeo)

Country features¶

The second view of IFF_Sector is to consider the reporter countries as the feature space. Below, I use the function create_features() and specify reporter.ISO as the features in order to generate the data-set for PCA. In this case, we have \(p=46\).

The interpretation in this application is to understand the variation in where the illicit outflows originate. This is because the values have been aggregated using the GER strategy which captures outflows only.

country_features = create_features(IFF_Sector_Imp, 'Imp_IFF_hi',

features='reporter.ISO', obs='section')

country_features

| reporter.ISO | AGO | BDI | BEN | BFA | BWA | CAF | CIV | CMR | COG | COM | ... | STP | SWZ | SYC | TGO | TUN | TZA | UGA | ZAF | ZMB | ZWE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| section | year | |||||||||||||||||||||

| Animal and Animal Products | 2000 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.00000 | 0.0 | ... | 0.000000 | 0.000000 | 0.000000e+00 | 4.044600e+06 | 1.572640e+07 | 1.060197e+06 | 2.902091e+05 | 2.341209e+07 | 0.000000e+00 | 0.000000e+00 |

| 2001 | 0.000000 | 0.000000 | 9.464068e+06 | 2.013378e+06 | 4.018742e+06 | 351958.882652 | 7.103384e+07 | 2.552567e+07 | 0.00000 | 0.0 | ... | 0.000000 | 0.000000 | 3.439935e+07 | 1.087398e+07 | 0.000000e+00 | 0.000000e+00 | 2.522664e+05 | 1.854458e+07 | 1.832385e+06 | 0.000000e+00 | |

| 2002 | 0.000000 | 288779.572593 | 1.458450e+07 | 7.756380e+05 | 3.524820e+06 | 213560.077651 | 7.767896e+07 | 2.907597e+07 | 0.00000 | 0.0 | ... | 0.000000 | 0.000000 | 0.000000e+00 | 6.574580e+06 | 9.664435e+06 | 0.000000e+00 | 6.944404e+05 | 1.452489e+07 | 4.354400e+05 | 7.346496e+06 | |

| 2003 | 0.000000 | 217920.960357 | 2.297721e+07 | 4.533317e+05 | 0.000000e+00 | 0.000000 | 1.286866e+08 | 3.485783e+07 | 0.00000 | 0.0 | ... | 0.000000 | 0.000000 | 0.000000e+00 | 6.290272e+06 | 1.732785e+07 | 1.294665e+06 | 1.358896e+06 | 2.153838e+07 | 1.422125e+06 | 0.000000e+00 | |

| 2004 | 0.000000 | 0.000000 | 2.742553e+07 | 3.429694e+05 | 5.275531e+04 | 0.000000 | 9.283012e+07 | 4.940023e+07 | 0.00000 | 0.0 | ... | 0.000000 | 59632.763605 | 0.000000e+00 | 3.901862e+06 | 3.574647e+07 | 0.000000e+00 | 8.053124e+05 | 2.868016e+07 | 2.791570e+06 | 0.000000e+00 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| Works of Art | 2012 | 739122.050820 | 0.000000 | 0.000000e+00 | 1.054676e+04 | 2.623004e+05 | 0.000000 | 1.820478e+04 | 3.875133e+05 | 0.00000 | 0.0 | ... | 0.000000 | 0.000000 | 0.000000e+00 | 1.125696e+03 | 0.000000e+00 | 7.252236e+04 | 1.388514e+04 | 1.371564e+07 | 3.453691e+04 | 5.967705e+04 |

| 2013 | 418841.640492 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 2.282032e+04 | 0.000000 | 1.287629e+04 | 2.104949e+04 | 0.00000 | 0.0 | ... | 9584.734907 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 5.191721e+05 | 2.986963e+04 | 1.006657e+07 | 1.017682e+05 | 0.000000e+00 | |

| 2014 | 390140.730849 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 9.331590e+04 | 0.000000 | 1.017252e+06 | 1.826816e+05 | 8003.37246 | 0.0 | ... | 20941.755221 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 6.731774e+04 | 2.129568e+04 | 2.543377e+07 | 0.000000e+00 | 0.000000e+00 | |

| 2015 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 5.977903e+04 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.00000 | 0.0 | ... | 4447.368931 | 0.000000 | 5.857979e+05 | 0.000000e+00 | 3.088086e+03 | 5.385830e+05 | 1.193596e+04 | 6.697451e+06 | 5.843484e+04 | 6.305071e+03 | |

| 2016 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 4.195233e+04 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.00000 | 0.0 | ... | 1327.652396 | 0.000000 | 4.463501e+05 | 0.000000e+00 | 0.000000e+00 | 3.443084e+04 | 2.305443e+03 | 1.295357e+07 | 0.000000e+00 | 0.000000e+00 |

357 rows × 46 columns

Biplots¶

The three figures below display biplots for the first and second principal components, for the third and fourth principal components, and for the fifth and sixth principal components, respectively. The loadings for each reporter country are also reported.

biplot_PCA(country_features, 10, 1, 2, obs='section', show_loadings=True)

| PC1 | PC2 | PC3 | PC4 | PC5 | PC6 | PC7 | PC8 | PC9 | PC10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| AGO | 0.172866 | 5.695754e-02 | 1.915290e-01 | -6.571267e-02 | -1.498597e-02 | 2.683983e-01 | -6.131957e-02 | -9.901379e-02 | -1.352142e-02 | 1.960619e-01 |

| BDI | 0.159396 | 1.399172e-02 | 1.100982e-01 | 1.072287e-01 | -5.780584e-02 | -3.006342e-02 | 1.311807e-01 | -6.306715e-02 | 8.380471e-02 | -1.595603e-01 |

| BEN | 0.166261 | 2.839527e-01 | -4.853377e-02 | -1.227506e-01 | -8.929173e-02 | 2.840864e-02 | -5.069704e-02 | -1.050768e-01 | 1.115173e-01 | -1.479526e-01 |

| BFA | 0.200912 | 1.961349e-01 | -1.479219e-02 | -3.284903e-02 | -7.687652e-03 | 1.947496e-01 | -8.961797e-03 | -9.812748e-02 | 5.298346e-02 | -6.100222e-02 |

| BWA | 0.058704 | 5.101605e-04 | 1.048248e-01 | 1.176491e-01 | 1.116177e-01 | 4.542630e-02 | 5.291913e-02 | 1.702242e-01 | 1.074927e-01 | 6.990029e-01 |

| CAF | 0.136213 | -2.941790e-01 | 7.144585e-02 | 1.466869e-01 | 1.005191e-01 | -8.211151e-04 | 1.767076e-02 | -9.841998e-02 | 4.459720e-02 | -6.455230e-02 |

| CIV | 0.170157 | -4.190252e-02 | -1.992766e-01 | -1.178971e-01 | -8.139640e-02 | 2.099028e-01 | 1.481461e-01 | -9.124417e-02 | 9.430036e-02 | -2.959315e-02 |

| CMR | 0.199563 | 6.685309e-03 | 2.723196e-02 | -1.591573e-01 | -1.158744e-01 | 4.651018e-02 | 4.997217e-02 | -4.900403e-02 | 6.736277e-02 | -4.601119e-02 |

| COG | 0.092230 | -1.314851e-01 | 3.146417e-01 | -1.361157e-01 | -2.737181e-01 | 2.682128e-01 | -4.522047e-02 | 1.802042e-02 | 4.328099e-02 | 3.111778e-02 |

| COM | 0.096409 | -2.063490e-01 | 2.921122e-01 | -2.226963e-01 | -7.053853e-02 | -1.456883e-01 | 8.379586e-02 | -6.576844e-02 | 9.280223e-02 | -1.472937e-01 |

| CPV | 0.162562 | -1.932140e-01 | 3.911200e-02 | -6.076881e-02 | 6.992487e-02 | 3.542767e-02 | 2.890140e-01 | -1.259045e-01 | 5.085305e-02 | -4.426356e-02 |

| DZA | 0.097941 | 4.125012e-02 | -3.694645e-02 | 4.185959e-01 | -2.291923e-01 | -2.224267e-01 | -7.905464e-02 | 8.880404e-02 | -9.011562e-02 | -5.841375e-02 |

| EGY | 0.175564 | 1.852732e-01 | 9.778806e-02 | 1.870187e-01 | 8.946189e-03 | -2.924499e-03 | 1.181851e-02 | -4.328654e-02 | 4.339753e-03 | -1.929171e-01 |

| ETH | 0.121994 | -1.897909e-01 | 7.695418e-02 | 3.167105e-01 | 2.484336e-01 | -1.802844e-01 | -7.872203e-02 | -9.597359e-02 | -2.026803e-02 | -1.094738e-01 |

| GAB | 0.042052 | -1.989049e-01 | -3.375917e-01 | 1.247060e-02 | -2.588424e-01 | -4.558121e-02 | 8.313195e-02 | 9.621236e-02 | -7.997286e-02 | -1.514322e-01 |

| GHA | 0.107784 | -1.996829e-01 | -6.503997e-02 | 6.007675e-02 | -3.272539e-01 | 2.451643e-01 | 4.926298e-02 | 2.807364e-01 | -3.340735e-01 | -5.059900e-03 |

| GIN | 0.052400 | -1.350973e-01 | -3.351174e-01 | -8.155761e-02 | -4.401417e-02 | -4.334381e-02 | -3.444465e-01 | -1.967460e-02 | 1.193137e-01 | -2.723141e-02 |

| GMB | 0.162689 | 8.598690e-02 | -9.929674e-02 | -2.316451e-01 | 2.262847e-01 | 1.330992e-01 | 2.662606e-01 | 1.742886e-01 | -9.401992e-02 | -6.012329e-02 |

| GNB | 0.000016 | -1.996604e-02 | -8.847847e-02 | -2.131943e-02 | 6.445089e-02 | 9.726163e-02 | -2.861441e-01 | 3.631337e-01 | 5.592464e-01 | -2.128313e-01 |

| KEN | 0.117135 | -1.733487e-01 | -2.826062e-01 | -1.414929e-01 | -4.852900e-02 | 1.122855e-01 | -1.773947e-01 | -2.061400e-01 | -2.190356e-01 | 1.721080e-01 |

| LBY | 0.000000 | 0.000000e+00 | -0.000000e+00 | 1.654361e-24 | 1.355253e-20 | 0.000000e+00 | 0.000000e+00 | 2.081668e-17 | -2.220446e-16 | -9.714451e-17 |

| LSO | 0.031001 | -1.145362e-01 | 1.172217e-01 | -8.783260e-02 | -6.316290e-02 | 1.845925e-01 | -1.155909e-01 | 4.273390e-01 | 1.846813e-01 | -2.597209e-02 |

| MAR | 0.196450 | -1.442017e-03 | -1.407898e-01 | -1.151253e-01 | 4.096951e-02 | -2.501230e-01 | -1.218791e-01 | -1.159986e-01 | -2.772756e-02 | 9.286997e-02 |

| MDG | 0.187159 | 1.768800e-01 | -7.603241e-02 | 1.954600e-02 | 3.882583e-02 | -6.632947e-02 | 1.303028e-02 | 1.697959e-01 | 3.997142e-02 | -1.389174e-01 |

| MLI | 0.160911 | -1.212446e-01 | -4.690084e-02 | -1.486856e-01 | 8.742975e-02 | -2.762972e-01 | 8.729569e-02 | 2.434701e-01 | -8.316575e-02 | 3.368757e-02 |

| MOZ | 0.147230 | 1.608981e-01 | 9.473738e-02 | -1.983947e-02 | -2.406356e-01 | -2.654582e-01 | -2.507807e-03 | 5.991142e-02 | 9.261240e-02 | 1.184466e-01 |

| MRT | 0.142351 | 2.001775e-01 | 7.014463e-02 | -1.332407e-01 | -2.101042e-01 | -3.003770e-01 | -1.237907e-01 | -9.258926e-02 | 7.149717e-02 | 1.249696e-01 |

| MUS | 0.183529 | 7.441746e-02 | -1.253785e-01 | 7.372575e-02 | 1.275615e-01 | 4.308231e-02 | 8.698864e-02 | 1.594759e-01 | 3.117765e-02 | 8.570793e-02 |

| MWI | 0.196370 | 1.208545e-01 | -1.804584e-02 | -1.462830e-01 | 2.430288e-02 | 7.000297e-02 | -7.395843e-02 | -3.780468e-02 | -6.553461e-02 | -1.841761e-02 |

| NAM | 0.173960 | 1.201903e-01 | 5.978034e-02 | 9.556719e-02 | 2.108371e-01 | -2.454492e-02 | 2.251590e-01 | 1.968563e-01 | -5.019903e-04 | 1.281223e-01 |

| NER | 0.191899 | -1.071062e-01 | 1.036822e-01 | -3.490165e-02 | 8.799988e-03 | 4.101665e-02 | -1.036213e-01 | -1.501394e-01 | 5.717845e-02 | 7.629436e-02 |

| NGA | 0.153000 | -8.916565e-02 | 2.197113e-01 | 2.082393e-02 | -2.395585e-01 | -1.659439e-01 | -1.019044e-01 | 1.527359e-01 | -3.809505e-02 | 8.557721e-02 |

| RWA | 0.186734 | -3.747262e-02 | 1.608489e-01 | 2.275355e-01 | 3.285765e-02 | 9.220145e-02 | -1.415166e-01 | -1.482959e-01 | -3.582179e-03 | 2.383508e-02 |

| SDN | 0.122997 | -2.804786e-01 | 1.221158e-01 | -1.345090e-01 | -5.996290e-02 | -1.354197e-01 | -2.219003e-02 | 1.378054e-01 | -7.715869e-02 | 7.151525e-04 |

| SEN | 0.198048 | -3.415201e-02 | -1.017232e-01 | -1.030800e-01 | -1.082653e-01 | -2.190300e-02 | -1.642827e-02 | -9.561341e-02 | -9.388535e-02 | 5.110459e-02 |

| SLE | 0.000000 | -2.281917e-34 | 3.682813e-32 | 6.034292e-30 | -1.730867e-25 | -3.631998e-25 | -1.524001e-23 | 1.682666e-21 | -1.953635e-20 | -7.252720e-21 |

| STP | 0.093915 | 2.692090e-01 | 7.292042e-02 | 2.717052e-01 | -2.160666e-01 | 2.404257e-01 | -1.858177e-02 | -4.529530e-03 | -4.636809e-02 | -6.325914e-02 |

| SWZ | 0.004459 | -9.037762e-02 | -2.172397e-01 | 4.529566e-02 | -1.475804e-01 | -4.240062e-03 | 1.559841e-01 | -2.357850e-01 | 5.362103e-01 | 2.615336e-01 |

| SYC | 0.012375 | -7.886680e-02 | -1.900444e-01 | 2.392704e-01 | -2.750048e-01 | -4.851200e-02 | 5.049505e-01 | 2.850039e-02 | 1.579691e-01 | 1.255474e-02 |

| TGO | 0.184941 | 8.829184e-02 | -4.195564e-02 | 1.516059e-02 | -3.407124e-02 | -7.070676e-02 | -2.815878e-02 | -5.328573e-03 | -7.180032e-03 | -5.552878e-02 |

| TUN | 0.189500 | -1.490447e-01 | -5.294429e-02 | 1.368356e-01 | 1.828756e-01 | 1.829014e-02 | -1.057055e-01 | 1.539954e-01 | 1.181978e-02 | -9.518775e-04 |

| TZA | 0.198557 | 1.129045e-01 | -8.978178e-02 | -1.479353e-01 | 1.914884e-01 | -8.737537e-02 | 1.348190e-01 | 8.895631e-02 | -7.496216e-02 | 2.430973e-02 |

| UGA | 0.220482 | 1.310309e-01 | -7.584076e-02 | 3.261941e-02 | 7.776106e-02 | 2.816737e-02 | -2.272271e-02 | 3.592921e-03 | -2.836216e-02 | -7.275351e-02 |

| ZAF | 0.190412 | -7.411430e-02 | -1.422615e-01 | 1.624323e-01 | 5.822959e-02 | -5.136024e-02 | -2.069728e-01 | 5.163535e-03 | -1.084788e-02 | 1.159689e-01 |

| ZMB | 0.150023 | -1.782886e-01 | -7.122649e-02 | 2.088026e-01 | 1.466777e-01 | 2.720530e-01 | -5.921551e-02 | -1.225385e-01 | 6.453899e-03 | -3.512622e-02 |

| ZWE | 0.098964 | -1.998928e-01 | 2.092424e-01 | -4.305728e-02 | 1.206815e-01 | -8.504574e-02 | 1.333520e-01 | -1.496703e-01 | 1.545886e-01 | -1.980936e-01 |

biplot_PCA(country_features, 10, 3, 4, obs='section')

biplot_PCA(country_features, 10, 5, 6, obs='section')

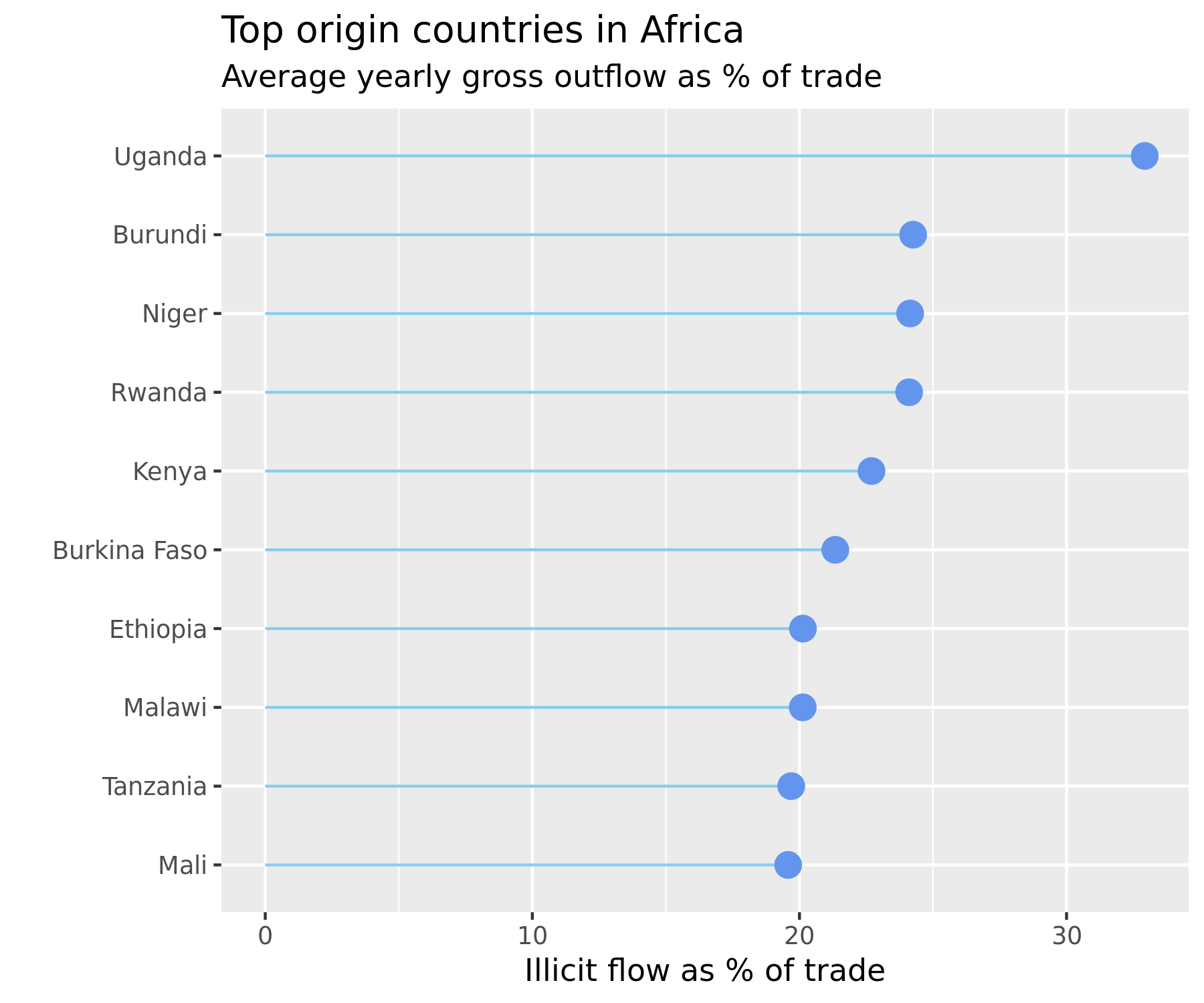

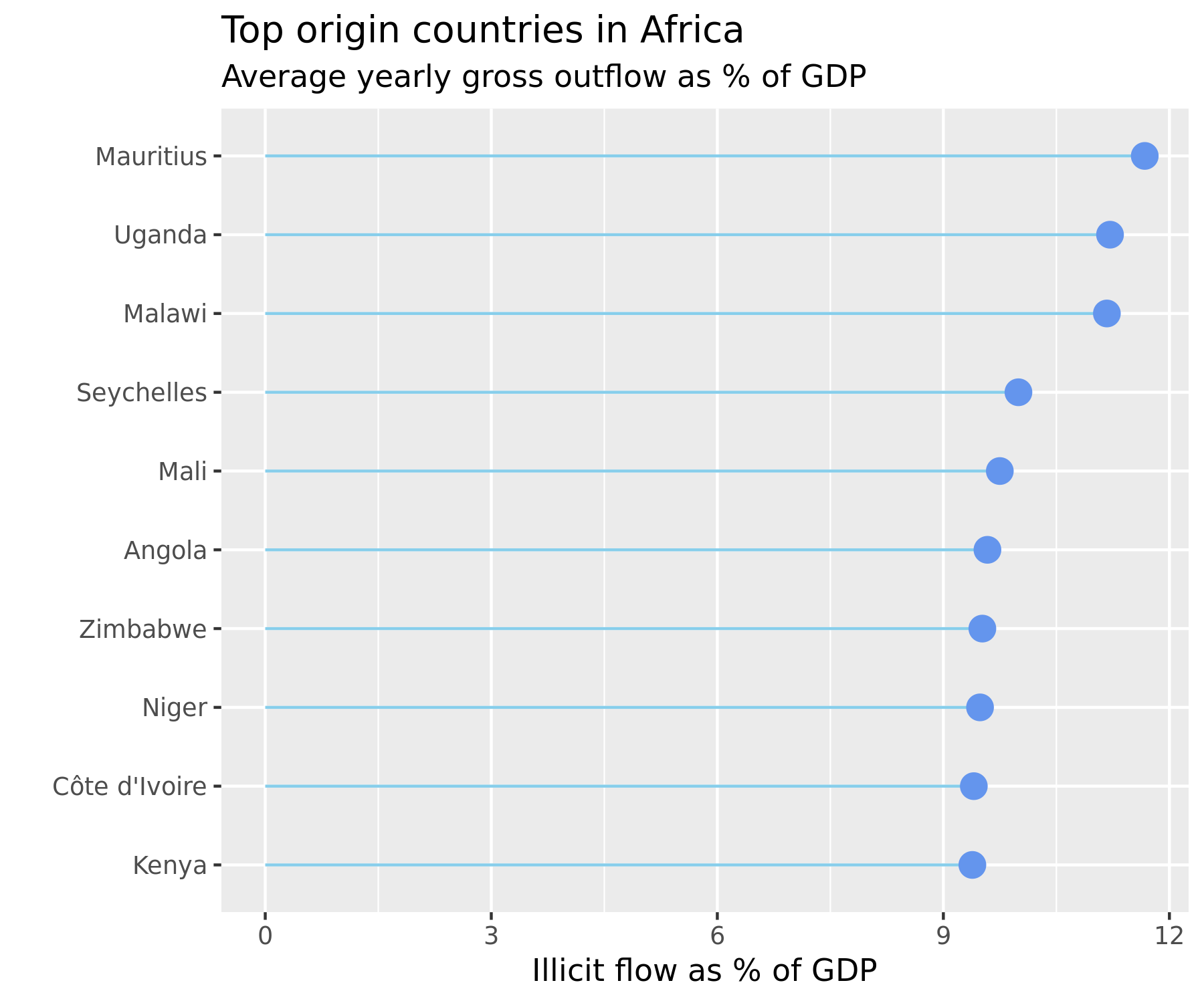

The interpretation should be carried out cautiously. The top loadings on the first principal components are Uganda, followed by Burkina Faso and Cameroon. Within Africa, Uganda is the country which experienced the highest gross outflows as a proportion of its total trade over the period 2000-2016, and the second highest as a proportion of its GDP over that same period (see figure below).

Source: generated by

Source: generated by Data Visualization.R in https://github.com/walice/Trade-IFF)

Source: generated by

Source: generated by Data Visualization.R in https://github.com/walice/Trade-IFF)

It is interesting to note that the PCA algorithm does not identify the countries which had the highest average dollar value of illicit outflows during 2000-2016, which were South Africa and Angola. This is because the data has been standardized to have mean 0 and unit variance, as is common when conducting PCA, since PCA is sensitive to outliers.

Rather, the PCA algorithm recovers in the top loadings for the most important principal components many of the countries that were among the top origins for outflows relative to trade or GDP, such as Burkina Faso, Ethiopia, Malawi, Seychelles, Mali, and Zimbabwe, even though the algorithm was run on (standardized) dollar values of outflows.

Explained variance¶

The first 6 principal components explain 63% of the variance in the data, with the first principal component explaining 38% of the variance alone.

scree_plot(country_features, show_explained_var=True)

| PC | var | |

|---|---|---|

| 0 | 1 | 3.763510e-01 |

| 1 | 2 | 7.215794e-02 |

| 2 | 3 | 5.939846e-02 |

| 3 | 4 | 5.123519e-02 |

| 4 | 5 | 3.787572e-02 |

| 5 | 6 | 3.396778e-02 |

| 6 | 7 | 3.106831e-02 |

| 7 | 8 | 2.638919e-02 |

| 8 | 9 | 2.585997e-02 |

| 9 | 10 | 2.268292e-02 |

| 10 | 11 | 2.200332e-02 |

| 11 | 12 | 2.037173e-02 |

| 12 | 13 | 1.925219e-02 |

| 13 | 14 | 1.910017e-02 |

| 14 | 15 | 1.719724e-02 |

| 15 | 16 | 1.561816e-02 |

| 16 | 17 | 1.346239e-02 |

| 17 | 18 | 1.260948e-02 |

| 18 | 19 | 1.150043e-02 |

| 19 | 20 | 1.118470e-02 |

| 20 | 21 | 1.060775e-02 |

| 21 | 22 | 8.985424e-03 |

| 22 | 23 | 8.762526e-03 |

| 23 | 24 | 8.330893e-03 |

| 24 | 25 | 6.857884e-03 |

| 25 | 26 | 6.636890e-03 |

| 26 | 27 | 5.660594e-03 |

| 27 | 28 | 5.216669e-03 |

| 28 | 29 | 4.582342e-03 |

| 29 | 30 | 4.137391e-03 |

| 30 | 31 | 3.673426e-03 |

| 31 | 32 | 3.514407e-03 |

| 32 | 33 | 3.274164e-03 |

| 33 | 34 | 3.004834e-03 |

| 34 | 35 | 2.840875e-03 |

| 35 | 36 | 2.611974e-03 |

| 36 | 37 | 2.263592e-03 |

| 37 | 38 | 2.120142e-03 |

| 38 | 39 | 1.688935e-03 |

| 39 | 40 | 1.536694e-03 |

| 40 | 41 | 1.461075e-03 |

| 41 | 42 | 1.319987e-03 |

| 42 | 43 | 9.527948e-04 |

| 43 | 44 | 6.724485e-04 |

| 44 | 45 | 1.776402e-33 |

| 45 | 46 | 1.776402e-33 |

Variance-stabilizing and normalizing transformations¶

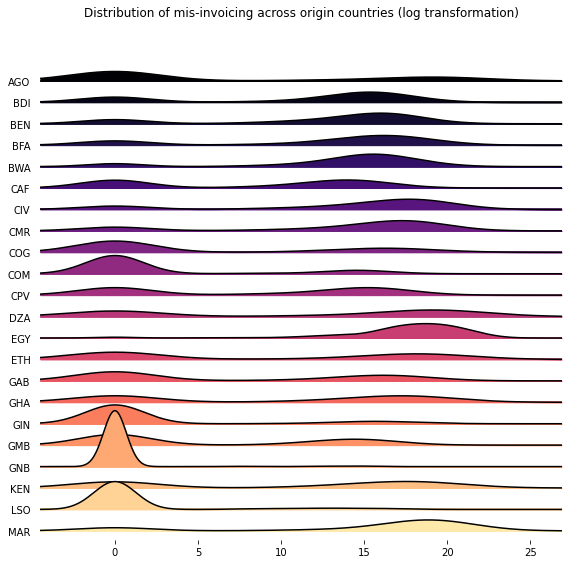

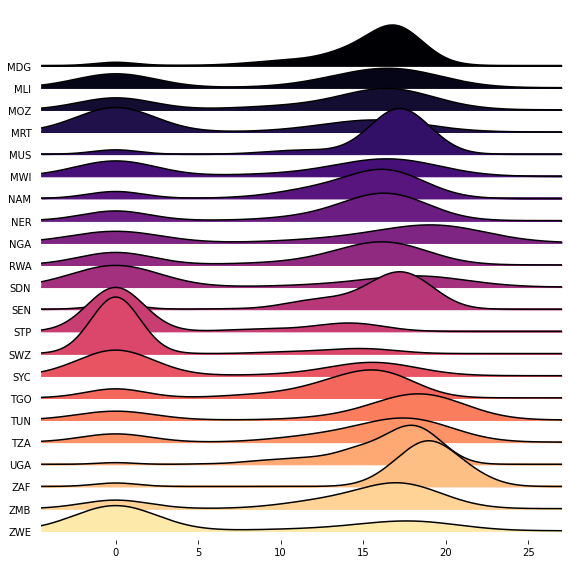

The figures below display the distribution of the mis-invoiced trade in each of the features of the feature space (after dropping those countries with 0 outflows in all sectors).

# Figure out which columns are composed of all 0s

country_features.apply(lambda x: (x == 0).all(), axis=0)

reporter.ISO

AGO False

BDI False

BEN False

BFA False

BWA False

CAF False

CIV False

CMR False

COG False

COM False

CPV False

DZA False

EGY False

ETH False

GAB False

GHA False

GIN False

GMB False

GNB False

KEN False

LBY True

LSO False

MAR False

MDG False

MLI False

MOZ False

MRT False

MUS False

MWI False

NAM False

NER False

NGA False

RWA False

SDN False

SEN False

SLE True

STP False

SWZ False

SYC False

TGO False

TUN False

TZA False

UGA False

ZAF False

ZMB False

ZWE False

dtype: bool

# Drop the corresponding features

country_features = country_features.drop(columns=['LBY', 'SLE'])

Again, I explore the consequences of applying a modified log transformation and a Yeo-Johnson transformation, respectively.

country_features_log = country_features.apply(lambda x: np.log(x+1) if np.issubdtype(x.dtype, np.number) else x, axis=0)

country_features_yeo = power_transform(country_features, method='yeo-johnson', standardize=True)

The top loadings on the first principal component, in both transformations, capture an origin hub located in the north-west of the continent with Benin, Niger, and Senegal featuring heavily.

The top loadings on the second principal component capture a south-southeast axis which runs from Gabon to Angola to Swaziland (now called Eswatini).

biplot_PCA(country_features_log, 10, 1, 2, obs='section')

biplot_PCA(country_features_yeo, 10, 1, 2, obs='section')

PCA on bilateral trade matrix¶

The previous sections explored relevant dimensions of variation by considering the feature space spanned by the origin of the illicit outflows, whether it be the source countries or the source sectors.

Now, I turn to exploring the relevant dimensions of illicit flows by analyzing the feature space spanned by the destination of those illicit outflows.

Let’s apply the create_features() function to the summary data-set IFF_Dest, where we have \(p=167\).

partner_features = create_features(IFF_Dest_Imp, 'Imp_IFF_hi',

features='partner.ISO', obs='reporter.ISO')

partner_features

| partner.ISO | AGO | ALB | AND | ARE | ARG | ARM | ATG | AUS | AUT | AZE | ... | URY | USA | VCT | VEN | VNM | VUT | YEM | ZAF | ZMB | ZWE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| reporter.ISO | year | |||||||||||||||||||||

| AGO | 2009 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 6.014820e+07 | 0.0 | 0 | 6.980492e+06 | 3.119279e+05 | 0.000000 | ... | 2.361993e+06 | 9.270820e+08 | 0 | 0.0 | 4.734647e+07 | 0 | 0.000000 | 1.016827e+09 | 1.060946e+05 | 309894.487818 |

| 2010 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 2.963158e+07 | 0.0 | 0 | 2.971282e+06 | 5.626929e+06 | 18935.636990 | ... | 1.644130e+06 | 8.268511e+08 | 0 | 0.0 | 2.970677e+07 | 0 | 0.000000 | 3.315930e+08 | 2.665205e+04 | 420951.156359 | |

| 2011 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 5.044258e+07 | 0.0 | 0 | 9.077825e+06 | 2.409418e+06 | 20266.842796 | ... | 1.016561e+06 | 8.601995e+08 | 0 | 0.0 | 2.451965e+07 | 0 | 0.000000 | 3.281534e+08 | 4.525653e+05 | 0.000000 | |

| 2012 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 2.055669e+08 | 0.0 | 0 | 7.483480e+06 | 1.354856e+07 | 22457.788787 | ... | 1.582490e+06 | 1.441162e+09 | 0 | 0.0 | 5.942382e+07 | 0 | 354866.063494 | 7.944924e+08 | 1.180964e+03 | 0.000000 | |

| 2013 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 5.839522e+07 | 0.0 | 0 | 1.569576e+07 | 8.770795e+06 | 1734.698687 | ... | 3.447835e+06 | 7.139003e+08 | 0 | 0.0 | 3.931132e+07 | 0 | 0.000000 | 4.272753e+08 | 2.855892e+05 | 0.000000 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| ZWE | 2011 | 0.0 | 0.0 | 0.0 | 5.290029e+07 | 2.310119e+07 | 0.0 | 0 | 2.325259e+06 | 3.171896e+05 | 0.000000 | ... | 2.721346e+04 | 6.462989e+08 | 0 | 0.0 | 5.288219e+06 | 0 | 0.000000 | 3.088036e+09 | 5.016118e+07 | 0.000000 |

| 2012 | 0.0 | 0.0 | 0.0 | 5.923175e+07 | 1.011059e+07 | 0.0 | 0 | 1.664879e+06 | 1.220841e+06 | 0.000000 | ... | 0.000000e+00 | 6.069423e+08 | 0 | 0.0 | 4.745996e+06 | 0 | 0.000000 | 1.242790e+09 | 1.704507e+08 | 0.000000 | |

| 2013 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 0.000000e+00 | 0.0 | 0 | 0.000000e+00 | 0.000000e+00 | 0.000000 | ... | 0.000000e+00 | 0.000000e+00 | 0 | 0.0 | 0.000000e+00 | 0 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000 | |

| 2014 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 0.000000e+00 | 0.0 | 0 | 0.000000e+00 | 0.000000e+00 | 0.000000 | ... | 0.000000e+00 | 0.000000e+00 | 0 | 0.0 | 0.000000e+00 | 0 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.000000 | |

| 2015 | 0.0 | 0.0 | 0.0 | 5.042948e+07 | 0.000000e+00 | 0.0 | 0 | 5.764013e+05 | 6.721992e+05 | 0.000000 | ... | 9.012925e+04 | 4.109564e+07 | 0 | 0.0 | 3.093477e+03 | 0 | 0.000000 | 6.474374e+08 | 0.000000e+00 | 0.000000 |

624 rows × 167 columns

Biplots¶

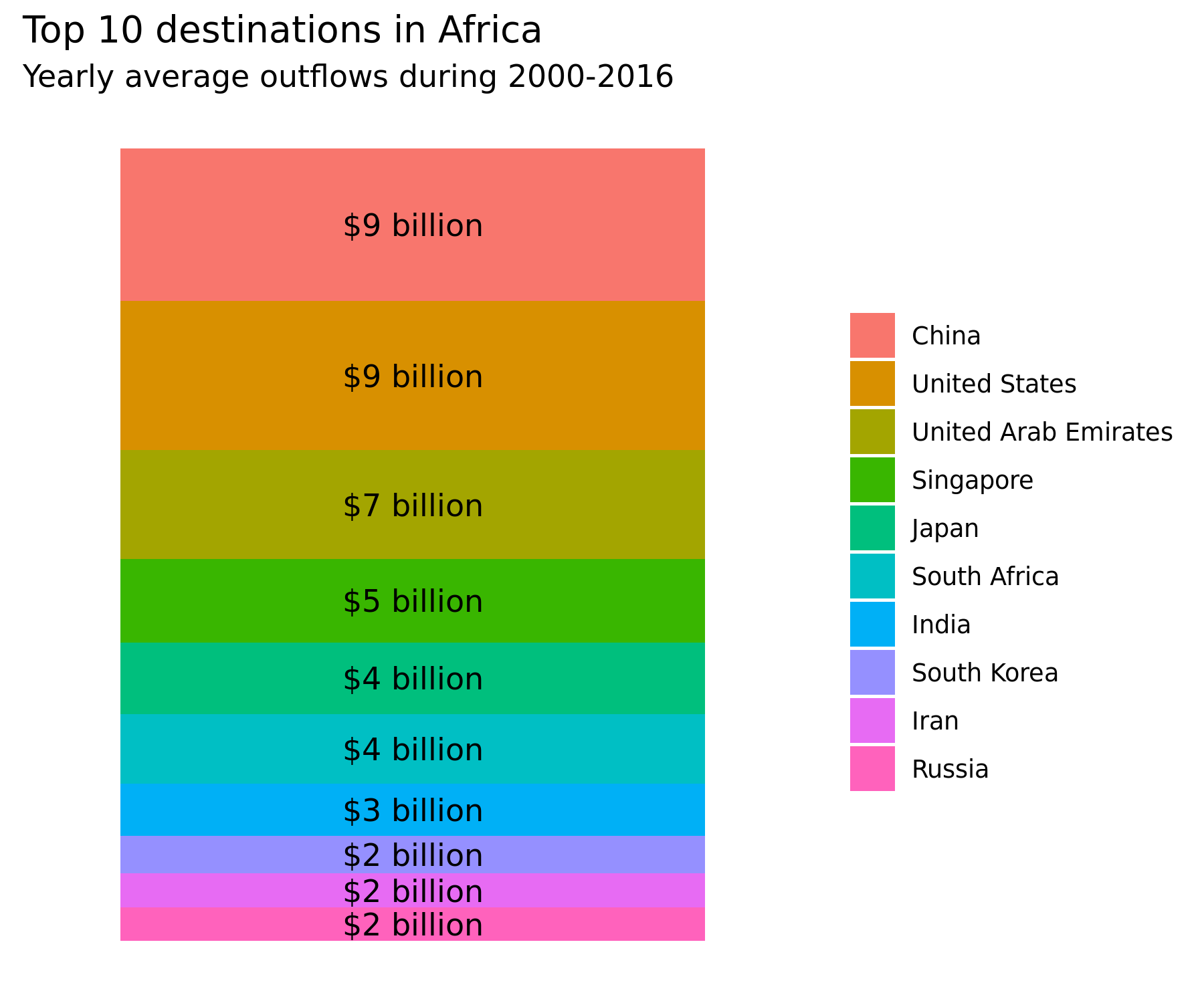

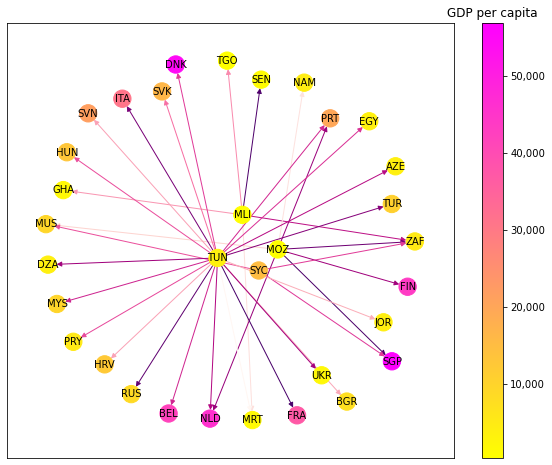

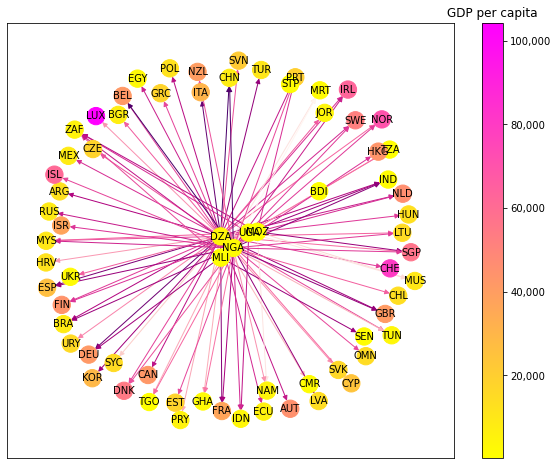

The figure below displays the first and second principal components. It appears that the first principal component recovers the top destinations of illicit outflows, as the first loading corresponds to China which was the top average destination for illicit outflows from Africa during 2000-2016, and the second loading corresponds to the United States which was the second largest destination.

biplot_PCA(partner_features, 10, 1, 2, show_loadings=True)

| PC1 | PC2 | PC3 | PC4 | PC5 | PC6 | PC7 | PC8 | PC9 | PC10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| AGO | 0.064538 | -0.127775 | -0.044675 | -0.081190 | 0.015199 | -0.030508 | -0.020684 | -0.075254 | 0.026087 | 0.018444 |

| ALB | 0.044858 | 0.100240 | -0.085332 | 0.010378 | 0.222166 | -0.056160 | 0.016405 | -0.068677 | 0.098802 | -0.006931 |

| AND | 0.002434 | 0.006593 | -0.006567 | 0.005445 | -0.015707 | 0.021064 | -0.006253 | -0.004508 | 0.001468 | -0.016877 |

| ARE | 0.091433 | -0.038099 | 0.067933 | -0.046062 | 0.123878 | -0.061712 | -0.030800 | 0.190913 | -0.147428 | 0.060691 |

| ARG | 0.129513 | 0.139207 | -0.082968 | 0.019367 | -0.043149 | 0.085106 | -0.014389 | 0.038525 | 0.024086 | 0.000942 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| VUT | 0.000000 | 0.000000 | 0.000000 | 0.000000 | -0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| YEM | 0.040005 | -0.060918 | 0.007451 | 0.143530 | 0.037673 | 0.037506 | 0.085598 | 0.261330 | 0.309931 | -0.017295 |

| ZAF | 0.008847 | 0.007834 | 0.091261 | -0.022447 | 0.026785 | 0.001632 | -0.043753 | 0.104236 | -0.037778 | 0.124183 |

| ZMB | 0.040152 | 0.020620 | -0.037492 | 0.009481 | 0.093282 | -0.176393 | -0.033166 | 0.069316 | -0.109787 | 0.018559 |

| ZWE | 0.058102 | -0.112442 | 0.020694 | 0.215291 | 0.042842 | 0.010566 | 0.044425 | 0.149634 | 0.182897 | 0.017658 |

167 rows × 10 columns

Source: generated by

Source: generated by Data Visualization.R in https://github.com/walice/Trade-IFF

The top loadings on the other principal components reveal some unexpected sources of variation for destination countries.

The top loadings are:

Second principal component:

Top loading 1: El Salvador

Top loading 2: Dominican Republic

Top loading 3: Nepal

Third principal component:

Top loading 1: Belgium

Top loading 2: Norway

Top loading 3: Panama

Fourth principal component:

Top loading 1: Iran

Top loading 2: Suriname

Top loading 3: Papua New Guinea

Fifth principal component:

Top loading 1: Central African Republic

Top loading 2: Kuwait

Top loading 3: Albania

Sixth principal component:

Top loading 1: Ecuador

Top loading 2: Slovenia

Top loading 3: Algeria

These dimensions of variation are much harder to interpret. Nevertheless, a few points stand out.

First, apart from the first principal component, the loadings do not appear to be driven by the magnitude of the illicit outflows. Second, the loadings recovered are surprising. One “usual suspect” which appears is Panama (on the third principal component) which is one of the oldest and best-known tax haven in the Americas. Third, this suggests that the analysis of the destinations of illicit outflows from Africa merits much deeper analysis to “follow the money” (which is outside the scope of this project).

biplot_PCA(partner_features, 10, 3, 4)

biplot_PCA(partner_features, 10, 5, 6)

Explained variance¶

With a feature space of \(p=167\), 12 principal components are required to explain at least 50% of the variance in the data.

scree_plot(partner_features)

Variance-stabilizing and normalizing transformations¶

The sections below explore the effect of variance-stabilizing transformations on the partner_features data-set.

Korea and Nicaragua appear as top loadings on the first and second principal components, respectively.

When running PCA on the transformed data, the projection of the principal component scores on the first two principal components takes on a half-moon shape.

Expand the code chunks to see the details.

# Figure out which columns are composed of all 0s

partner_features.apply(lambda x: (x == 0).all(), axis=0)

noIFFpartner = partner_features.loc[:,partner_features.apply(lambda x: (x == 0).all(), axis=0)].columns.tolist()

noIFFpartner

['ATG',

'BLZ',

'BMU',

'DMA',

'GNB',

'GRD',

'KGZ',

'KNA',

'LCA',

'SLB',

'TON',

'VCT',

'VUT']

# Drop the corresponding features

partner_features = partner_features.drop(columns=noIFFpartner)

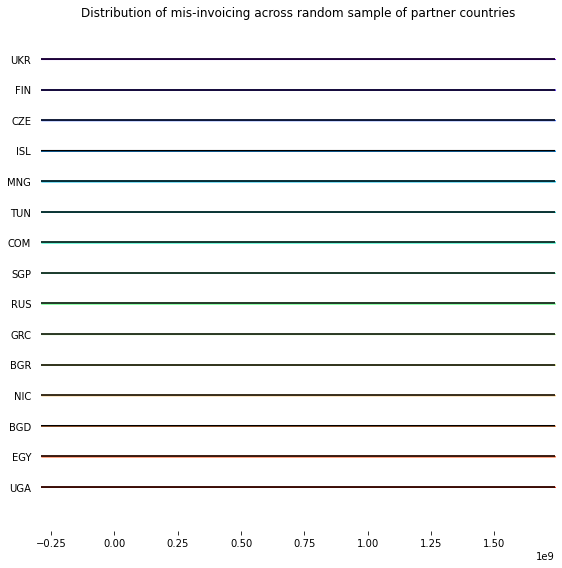

# Plot the distribution of illicit flows for a random sample of partner countries

fig, axes = joypy.joyplot(partner_features.sample(n=15, axis=1, random_state=234),

colormap=plt.cm.rainbow, figsize=(8,8),

title='Distribution of mis-invoicing across random sample of partner countries');

# Apply a modified log transformation

partner_features_log = partner_features.apply(lambda x: np.log(x+1) if np.issubdtype(x.dtype, np.number) else x, axis=1)

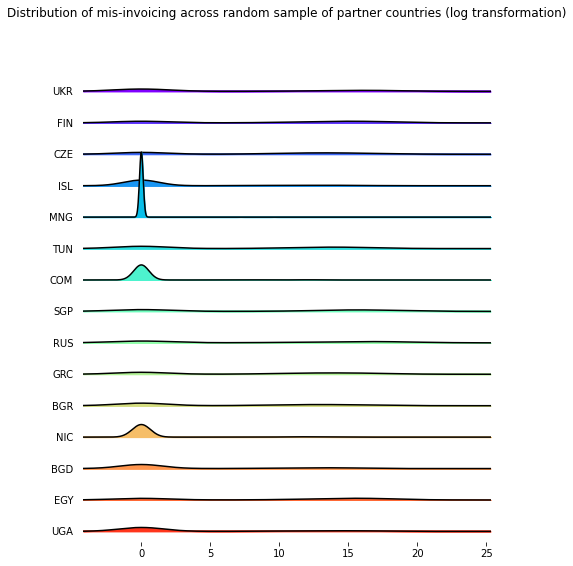

# Plot the distribution of illicit flows for the transformed data

fig, axes = joypy.joyplot(partner_features_log.sample(n=15, axis=1, random_state=234),

colormap=plt.cm.rainbow, figsize=(8,8),

title='Distribution of mis-invoicing across random sample of partner countries (log transformation)');

# Biplot for the first 2 principal components for the transformed data (modified log)

biplot_PCA(partner_features_log, 10, 1, 2)

# Apply a modified Yeo-Johnson transformation

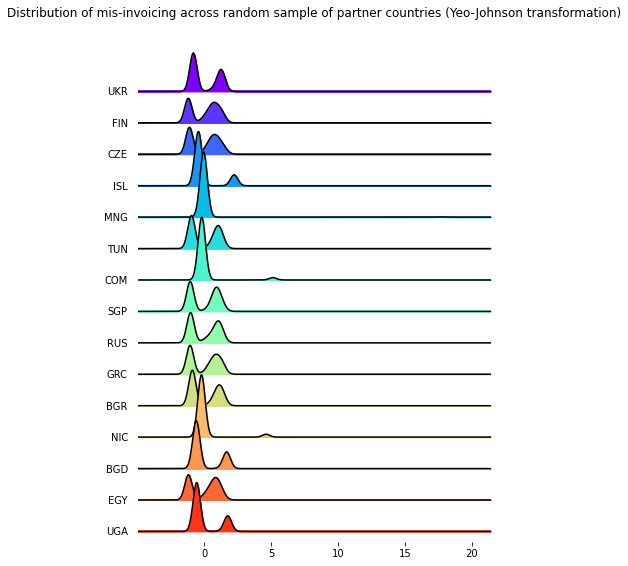

partner_features_yeo = power_transform(partner_features, method='yeo-johnson', standardize=True)

# Plot the distribution of illicit flows for the transformed data

partner_features_yeo = pd.DataFrame(partner_features_yeo,

index=partner_features.index,

columns=partner_features.columns)

random.seed(234)

fig, axes = joypy.joyplot(partner_features_yeo.sample(n=15, axis=1, random_state=234),

colormap=plt.cm.rainbow, figsize=(8,8),

title='Distribution of mis-invoicing across random sample of partner countries (Yeo-Johnson transformation)');

# Biplot for the first 2 principal components for the transformed data (Yeo-Johnson)

biplot_PCA(partner_features_yeo, 10, 1, 2)

Intra-African illicit financial flows¶

The analysis will now be restricted to intra-African illicit financial flows, that is, illicit capital that originates from African countries and which flows to African countries too.

Data wrangling¶

# Import bilateral trade mis-invoicing data

IFF_Dest = pd.read_csv('Data/GER_Orig_Dest_Year_Africa.csv')

# Restrict to destinations in Africa only

IFF_Dest_AFR = IFF_Dest[IFF_Dest['pRegion'] == 'Africa']

IFF_Dest_AFR = IFF_Dest_AFR.fillna(0).drop(columns=['reporter', 'rIncome', 'rDev',

'partner', 'pRegion', 'pIncome', 'pDev',

'Imp_IFF_lo', 'Exp_IFF_lo']) \

.set_index(['reporter.ISO', 'year'])

# Extract trade mis-invoicing in imports and exports, respectively

IFF_Dest_Imp_AFR = IFF_Dest_AFR[['partner.ISO', 'Imp_IFF_hi']]

IFF_Dest_Exp_AFR = IFF_Dest_AFR[['partner.ISO', 'Exp_IFF_hi']]

Let’s create the feature space from the African partner countries which are the destinations of illicit ouflows originating from the countries listed in reporter.ISO.

partner_features_AFR = create_features(IFF_Dest_Imp_AFR, 'Imp_IFF_hi',

features='partner.ISO', obs='reporter.ISO')

partner_features_AFR

| partner.ISO | AGO | BDI | BEN | BFA | BWA | CAF | CIV | CMR | COG | COM | ... | STP | SWZ | SYC | TGO | TUN | TZA | UGA | ZAF | ZMB | ZWE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| reporter.ISO | year | |||||||||||||||||||||

| AGO | 2009 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 0.0 | 7.356525e+05 | 0.000000 | 0.000000e+00 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 1.628157e+06 | 0.000000e+00 | 0.0 | 1.016827e+09 | 1.060946e+05 | 309894.487818 |

| 2010 | 0.0 | 0.0 | 0.0 | 0.0 | 2.025235e+05 | 0.0 | 5.577699e+07 | 53088.378146 | 1.402793e+08 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 252999.300576 | 1.137066e+08 | 5.529461e+03 | 0.0 | 3.315930e+08 | 2.665205e+04 | 420951.156359 | |

| 2011 | 0.0 | 0.0 | 0.0 | 0.0 | 5.501246e+03 | 0.0 | 6.262938e+06 | 257786.746458 | 3.466061e+07 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 4.623718e+07 | 1.745372e+06 | 0.0 | 3.281534e+08 | 4.525653e+05 | 0.000000 | |

| 2012 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 0.0 | 1.425377e+07 | 222663.224270 | 2.587614e+07 | 0.0 | ... | 8435.069683 | 0.0 | 0.0 | 0.000000 | 1.262796e+07 | 1.253616e+05 | 0.0 | 7.944924e+08 | 1.180964e+03 | 0.000000 | |

| 2013 | 0.0 | 0.0 | 0.0 | 0.0 | 2.945193e+05 | 0.0 | 2.125395e+06 | 0.000000 | 4.357466e+06 | 0.0 | ... | 957.605075 | 0.0 | 0.0 | 0.000000 | 4.438123e+06 | 1.035603e+05 | 0.0 | 4.272753e+08 | 2.855892e+05 | 0.000000 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| ZWE | 2011 | 0.0 | 0.0 | 0.0 | 0.0 | 8.741233e+07 | 0.0 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 0.000000e+00 | 1.295280e+06 | 0.0 | 3.088036e+09 | 5.016118e+07 | 0.000000 |

| 2012 | 0.0 | 0.0 | 0.0 | 0.0 | 3.187848e+07 | 0.0 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 0.000000e+00 | 2.729399e+06 | 0.0 | 1.242790e+09 | 1.704507e+08 | 0.000000 | |

| 2013 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 0.0 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.0 | 0.000000e+00 | 0.000000e+00 | 0.000000 | |

| 2014 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000e+00 | 0.0 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 0.000000e+00 | 0.000000e+00 | 0.0 | 0.000000e+00 | 0.000000e+00 | 0.000000 | |

| 2015 | 0.0 | 0.0 | 0.0 | 0.0 | 8.142369e+06 | 0.0 | 0.000000e+00 | 0.000000 | 0.000000e+00 | 0.0 | ... | 0.000000 | 0.0 | 0.0 | 0.000000 | 0.000000e+00 | 8.238550e+06 | 0.0 | 6.474374e+08 | 0.000000e+00 | 0.000000 |

604 rows × 46 columns

There are strong regional dynamics in international trade, so it is useful to extract information on which regions the countries belong to. The crosswalk data-set includes information on the geographical groupings of each country. The codes are taken from the UN Statistics Division M49 standard (https://unstats.un.org/unsd/methodology/m49/).

The UN_Intermediate_Region code is nested within the UN_Sub-region code. In the M49 standard grouping for Africa, there are two sub-regions: Northern Africa and Sub-Saharan Africa. The latter contains further geographical groupings: Eastern Africa, Middle Africa, Southern Africa, Western Africa. Therefore, we need to reconcile both so that the regional labels include Northern Africa and the 4 groupings within Sub-Saharan Africa. The code below achieves this, and this is automatized by the region_labels() function further down.

# Merge in UN Intermediate Region groups

partner_features_AFR = pd.merge(left=partner_features_AFR.reset_index(),

right=crosswalk[['ISO3166.3', 'UN_Intermediate_Region']].drop_duplicates('ISO3166.3'),

how='left',

left_on='reporter.ISO', right_on='ISO3166.3')

# Which African countries do not have a UN Intermediate region?

noregion_mask = partner_features_AFR['UN_Intermediate_Region'].isnull()

countries_noregion = partner_features_AFR[noregion_mask]['reporter.ISO'].unique().tolist()

countries_noregion

['DZA', 'EGY', 'LBY', 'MAR', 'SDN', 'TUN']

# Which UN Sub-region do those countries belong to?

crosswalk[crosswalk['ISO3166.3'].isin(countries_noregion)]['UN_Sub-region'].unique()

array(['Northern Africa'], dtype=object)

# Assign Northern Africa as a group for those countries

partner_features_AFR.loc[partner_features_AFR['reporter.ISO'].isin(countries_noregion), 'UN_Intermediate_Region'] = 'Northern Africa'

partner_features_AFR = partner_features_AFR.set_index(['reporter.ISO', 'year']).drop(columns=['ISO3166.3', 'UN_Intermediate_Region'])

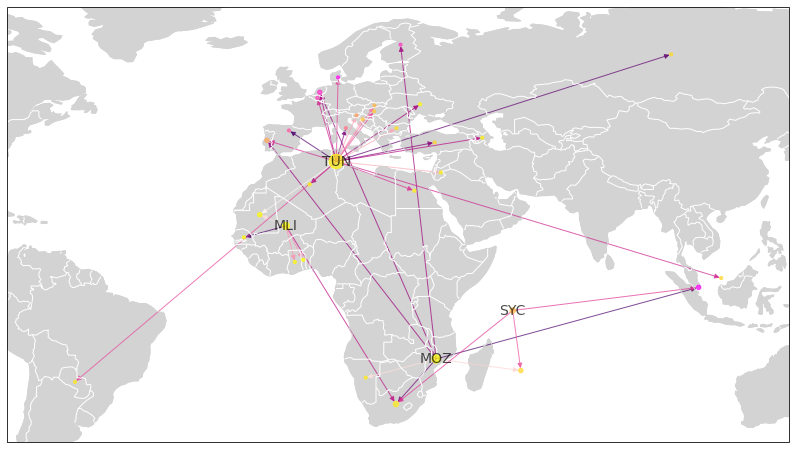

The figure below displays the biplot for the first two principal components estimated using the intra-African bilateral matrix of illicit flows.

biplot_PCA(partner_features_AFR, partner_features_AFR.shape[1], 1, 2)

The countries with the top 3 loadings on the first principal component are Mozambique (MOZ), Madagascar (MDG) and Comoros (COM). Madagascar and the Comoros are islands in the Mozambique channel, where two well-known conduits of illicit financial flows are located: the Seychelles and Mauritius.

The second principal component seems to capture Northern Africa, with Algeria and Tunisia scoring the second and third largest loading, respectively.

Removing outliers¶

There are vibrant debates in the field on estimating trade mis-invoicing based on mismatches in official trade data, much of which is outside the scope of this project. However, suffice to say that there are some outliers that might have large values of mis-invoicing due to benign reasons. For example, South Africa does not report gold exports to UN Comtrade (the underlying source of official trade statistis), and so any discrepancies found by looking at its mirrored trade statistics would result in spurious mis-invoicing estimates.

I remove outliers based on extreme values on the first two principal components. This effectively removes most of the observations for South Africa. Further work is needed, though, to remove outliers based on domain knowledge, especially if using this data to do a deep dive on certain dimensions (rather than looking at aggregate patterns, as is the case here).

features_data_std = StandardScaler().fit_transform(partner_features_AFR)

pca = PCA(n_components=partner_features_AFR.shape[1])

princ_comp = pca.fit_transform(features_data_std)

outlying = (princ_comp[:,0] > 6) | (princ_comp[:,1] > 4)

partner_features_AFR[outlying].index

MultiIndex([('AGO', 2010),

('CIV', 2013),

('EGY', 2012),

('GHA', 2002),

('MAR', 2005),

('MAR', 2006),

('MAR', 2007),

('MAR', 2008),

('MAR', 2009),

('MAR', 2010),

('MAR', 2011),

('MAR', 2012),

('NGA', 2011),

('ZAF', 2005),

('ZAF', 2006),

('ZAF', 2008),

('ZAF', 2010),

('ZAF', 2011),

('ZAF', 2012),

('ZAF', 2013),

('ZAF', 2014),

('ZAF', 2015),

('ZAF', 2016)],

names=['reporter.ISO', 'year'])

partner_features_AFR_noout = partner_features_AFR[~outlying]

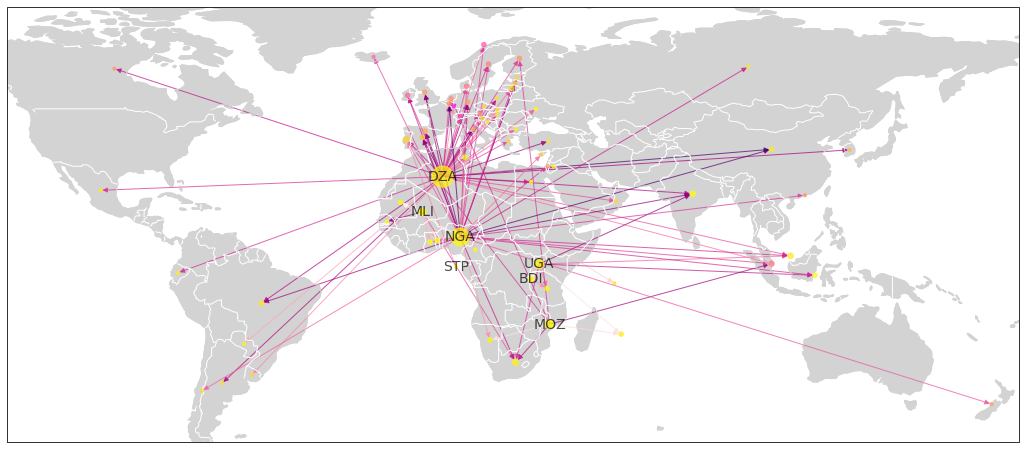

The figure below displays the projection of the data without outliers on the first 2 principal components. Some interesting regional patterns appear.

Top loadings on the first principal component seem to capture a western African hub, with Cote d’Ivoire and Togo scoring highly. By contrast, the second principal component seems to recover a southern African hub, with top loadings going to South Africa, Malawi, and Botswana.

biplot_PCA(partner_features_AFR_noout, 46, 1, 2)

In order to discern better any groupings, the next section will color the observations according to an aggregate class label.

Coloring by class label¶

The function region_labels() extracts the regional labels from the crosswalk and further divides the “Sub-Saharan Africa” group into its 4 corresponding subgroups, as discussed above.

def region_labels(features_data):

"""

Return regional labels for countries in the data

features_data: as Pandas dataframe, data-set of features

"""

# Extract observation labels from features data

obs_labels = pd.DataFrame(features_data.reset_index().set_index('reporter.ISO').index)

# Merge with UN intermediate regions from crosswalk

obs_labels = pd.merge(left=obs_labels,

right=crosswalk[['ISO3166.3', 'UN_Intermediate_Region']].drop_duplicates('ISO3166.3'),

how='left',

left_on='reporter.ISO', right_on='ISO3166.3') \

.drop(columns='ISO3166.3')

# Create a mask for the Northern African regions and replace the missing intermediate region

noregion_mask = obs_labels['UN_Intermediate_Region'].isnull()

countries_noregion = obs_labels[noregion_mask]['reporter.ISO'].unique().tolist()

obs_labels.loc[obs_labels['reporter.ISO'].isin(countries_noregion), 'UN_Intermediate_Region'] = 'Northern Africa'

return obs_labels

The function biplot_PCA_classes() projects the data in the two principal components chosen by the user, and further colors the observations either according to their UN regional grouping (by specifying classes='UN_Intermediate_Region') or according to their World Bank income group classification (by specifying classes='Income group (World Bank)').

def biplot_PCA_classes(features_data, nPC=2, firstPC=1, secondPC=2, classes='UN_Intermediate_Region'):

"""

Projects the data in the 2-dimensional space spanned by 2 principal components

chosen by the user, along with a bi-plot of the top 3 loadings per PC, and colors

by class label.

Args:

features_data: data-set of features

nPC: number of principal components

firstPC: integer denoting first principal component to plot in bi-plot

secondPC: integer denoting second principal component to plot in bi-plot

classes: {'UN_Intermediate_Region', 'Income group (World Bank)'}, as string, class label

by which to color observations

Returns:

plot (interactive)

pca_loadings (if show_loadings=True)

"""

# Unit of observation is the reporting country

obs='reporter.ISO'

# Run PCA (standardize beforehand)

features_data_std = StandardScaler().fit_transform(features_data)

# features_data_std = power_transform(features_data, method='yeo-johnson', standardize=True)

pca = PCA(n_components=nPC, random_state=234)

princ_comp = pca.fit_transform(features_data_std)

# Loadings

cols = ['PC' + str(c+1) for c in np.arange(nPC)]

pca_loadings = pd.DataFrame(pca.components_.T,

columns=cols,

index=list(features_data.columns))

# Scores

pca_scores = pd.DataFrame(princ_comp,

columns=cols)

pca_scores[obs] = features_data.reset_index()[obs].values.tolist()

pca_scores['year'] = features_data.reset_index()['year'].values.tolist()

score_PC1 = princ_comp[:,firstPC-1]

score_PC2 = princ_comp[:,secondPC-1]

# Plot data

plot_data = pd.merge(pca_scores, obs_info, on=[obs, 'year'])

tooltip_obs = ['reporter', 'year', 'Income group (World Bank)', 'Country status (UN)']

obs_labels = region_labels(features_data)

plot_data = pd.merge(left=plot_data, right=obs_labels.drop_duplicates('reporter.ISO'), on='reporter.ISO')

if classes == 'UN_Intermediate_Region':

color_scheme = 'paired'

else:

color_scheme = 'dark2'

# Return chosen PCs to plot

PC1 = 'PC'+str(firstPC)

PC2 = 'PC'+str(secondPC)

# Top loadings (in absolute value)

# TO DO: use dict to iterate over

toploadings_PC1 = pca_loadings.apply(lambda x: abs(x)).sort_values(by=PC1).tail(3)[[PC1, PC2]]

toploadings_PC2 = pca_loadings.apply(lambda x: abs(x)).sort_values(by=PC2).tail(3)[[PC1, PC2]]

originsPC1 = pd.DataFrame({'index':toploadings_PC1.index.tolist(),

PC1: np.zeros(3),

PC2: np.zeros(3)})

originsPC2 = pd.DataFrame({'index':toploadings_PC2.index.tolist(),

PC1: np.zeros(3),

PC2: np.zeros(3)})

toploadings_PC1 = pd.concat([toploadings_PC1.reset_index(), originsPC1], axis=0)

toploadings_PC2 = pd.concat([toploadings_PC2.reset_index(), originsPC2], axis=0)

toploadings_PC1[PC1] = toploadings_PC1[PC1]*max(score_PC1)*1.5

toploadings_PC1[PC2] = toploadings_PC1[PC2]*max(score_PC2)*1.5

toploadings_PC2[PC1] = toploadings_PC2[PC1]*max(score_PC1)*1.5

toploadings_PC2[PC2] = toploadings_PC2[PC2]*max(score_PC2)*1.5

# Project top 3 loadings over the space spanned by 2 principal components

lines = alt.Chart().mark_line().encode()

for color, i, dataset in zip(['#440154FF', '#21908CFF'], [0,1], [toploadings_PC1, toploadings_PC2]):

lines[i] = alt.Chart(dataset).mark_line(color=color).encode(

x= PC1 +':Q',

y= PC2 +':Q',

detail='index'

).properties(

width=400,

height=400

)

# Add labels to the loadings

text=alt.Chart().mark_text().encode()

for color, i, dataset in zip(['#440154FF', '#21908CFF'], [0, 1], [toploadings_PC1[0:3], toploadings_PC2[0:3]]):

text[i] = alt.Chart(dataset).mark_text(

align='left',

baseline='bottom',

color=color

).encode(

x= PC1 +':Q',

y= PC2 +':Q',

text='index'

)

# Scatter plot colored by observation class label

points = alt.Chart(plot_data).mark_circle(size=60).encode(

x=alt.X(PC1, axis=alt.Axis(title='Principal Component ' + str(firstPC))),

y=alt.X(PC2, axis=alt.Axis(title='Principal Component ' + str(secondPC))),

color=alt.Color(classes, scale=alt.Scale(scheme=color_scheme),

legend=alt.Legend(orient='right')),

tooltip=tooltip_obs

).interactive()

chart = (points + lines[0] + lines[1] + text[0] + text[1])

chart.display()

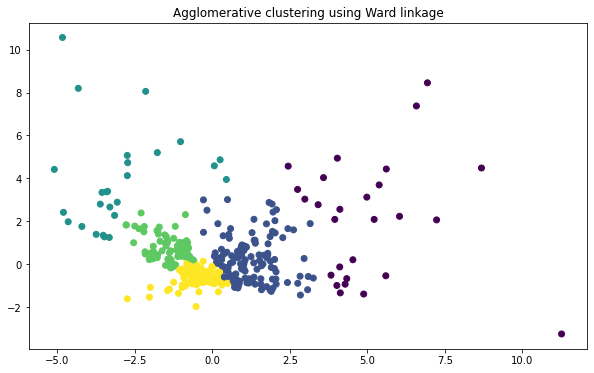

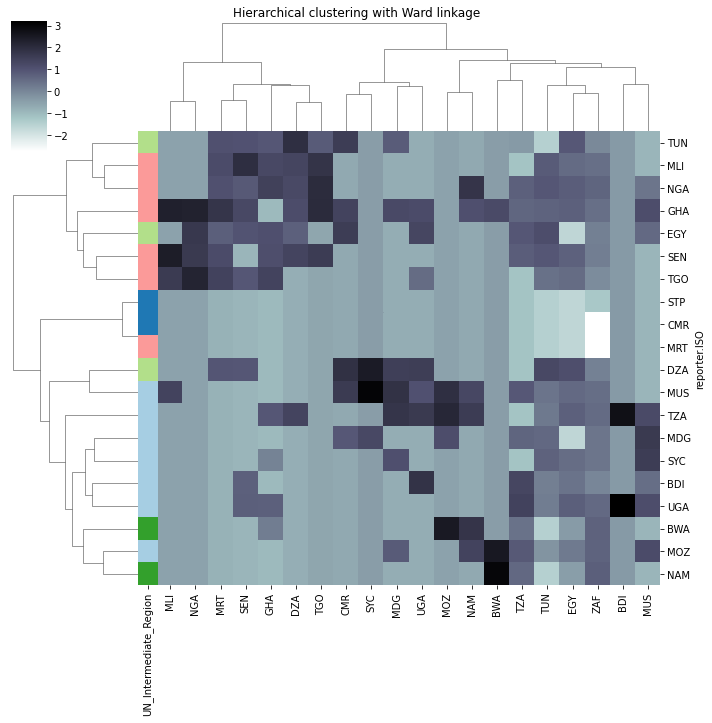

The following graphs suggest that the first two components of PCA seem to partition the feature space remarkably well according to regional groupings, and to a lesser extent according to income grouping. It should be noted that there is less variation in the income groupings in Africa as a whole, with few countries belong to the high income group.

The biplot which uses African partner countries as the feature space (after removing outliers) and which colors by regional grouping is the most striking (scroll down below to see it). Recall that the loadings refer to the partner countries (i.e. the destinations of the illicit outflows) which have the heaviest loadings on the first/second principal components, while the observations are colored according to the reporter country (i.e. the origin of the illicit flow). This biplot suggests that the partner features which have the highest weight on the first principal components correspond to a western African hub (Cote d’Ivoire and Togo), and that those observations with the highest principal component scores in that rotated space correspond to western African reporting countries.

Similarly, the largest weights on the second principal component refer to a southern African partner hub (South Africa, Malawi, and Botswana), while the observations with the highest scores correspond to northern and southern African countries.